The Biden Administration’s Costly New Workaround for Student Loan Cancellation

- BY Sarah Coffey

Americans who paid their way through college, who did not go to college, or who are diligently paying off their college loans shouldn’t have to pay for the student loans of others.

And the Supreme Court agrees. The Court just ruled that the U.S. Department of Education does not, in fact, have the authority to unilaterally cancel up to $20,000 in federal student loan debt per borrower.

Not to be deterred by common sense, the Biden administration is cooking up another rule that would force Americans to pay for others’ student loans.

The Biden administration proposes costly changes to income-driven repayment plans

In a new paper for FGA, Senior Research Fellow Michael Greibrok exposes how a new proposed rule would incentivize student loan borrowers to take on even more college debt and leave taxpayers footing the bill.

According to the paper, this new rule would bring dramatic changes to income-driven repayment (IDR) plans. These plans were initially designed to help borrowers pay off portions of their loans early on in their careers when their debt-to-income ratio may be high. Changes to the plan would raise the level of income considered non-discretionary, meaning more of the borrower’s total income would be exempted when establishing repayment rates for loans.

Borrowers would have to pay less, but taxpayers would end up paying more

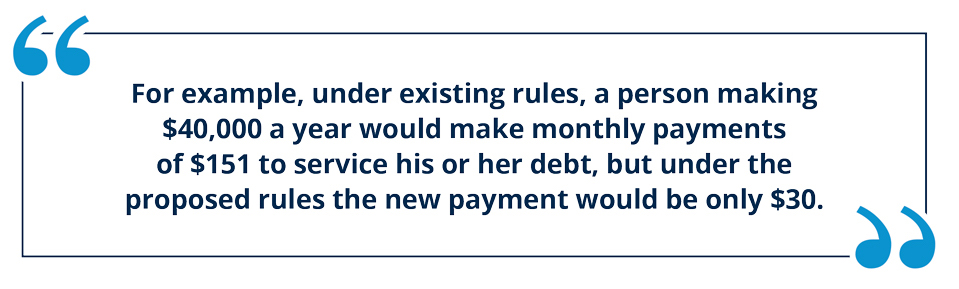

This proposed rule makes it so income up to 225 percent of the federal poverty level (roughly equivalent to $33,000) is exempt from the calculation of a borrower’s payment on their student loans. As a result, borrowers making more than 225 percent of the federal poverty level would see their monthly payments reduced dramatically:

The paper warns that the rule would transfer loan balances to taxpayers after 10 years instead of the current 20 years for those who originally borrowed $12,000 or less. The rule would allow some borrowers to pay nothing on their loans each month, and after 10 years, the burden for the loan would be shifted to taxpayers’ shoulders…meaning higher taxes for all to pay off this expensive scheme.

Student loan cancellation is expensive and won’t help lower tuition costs

Greibrok also points out just how costly the rule would be. The Congressional Budget Office (CBO) estimates it would cost around $230 billion. But the cost would likely be much, much higher because the CBO’s numbers assume that the number of people using the current Revised Pay as You Earn (REPAYE) Plan would stay the same and not increase. But more Americans would likely begin using this plan if the proposed changes to the REPAYE Plan were implemented, driving the number of borrowers and the number of dollars borrowed even higher.

And the elephant in the room? This won’t help the student loan debt crisis and it won’t address the staggeringly high costs of college. It will only make both situations worse:

- Because this rule will more quickly remove the debt burden from borrowers, more people will take out college loans in the future.

- This rule will all but ensure that the government and by extension, the taxpayer, will be on the hook for student loan debts, while educational institutions will be incentivized to further increase the cost of tuition. Why wouldn’t they, when the government is proposing a rule that allows for lower student loan repayment rates and easier debt forgiveness by applying for larger loans?

The bottom line? The president’s new IDR rule will cost taxpayers billions and will do virtually nothing to address the student loan crisis and the high cost of tuition. A measure like the Regulations from the Executive in Need of Scrutiny (REINS) Act would make a difference, though: It would require expensive rules like this one to be reviewed and approved by Congress before they can take effect.

Read the paper here and learn more about the student loan debt crisis and our solutions here.