President Biden’s Proposed Student Loan Rule Would Cost Taxpayers Billions

KEY FINDINGS

- The proposed rule would alter Income-Driven Repayment (IDR) plans, allowing some individuals making more than double the federal poverty level to escape their student loans without making any payments.

- It would come at an estimated cost of upwards of $471 billion over 10 years.

- Borrowers would be left with an unrealistic expectation of how to plan for debt and rising tuition costs would be unaddressed.

- Federal lawmakers should pass the Regulations from the Executive in Need of Scrutiny (REINS) Act to require congressional approval of costly rules before bureaucrats can implement them.

Overview

The Biden administration is doubling down on harmful student loan initiatives. In August 2022, it released a plan to wipe out up to $20,000 in student loan debt per borrower.1-2 This giveaway was paused after an appeals court put in place a nationwide injunction and the Supreme Court later struck it down as being beyond the administration’s authority.3-4 A new proposed rule would alter IDR plans, costing taxpayers billions.5

The proposed rule would burden taxpayers with college loan debt and fails to address the rising cost of tuition. Instead, the rule would incentivize borrowers to take on more debt and leave taxpayers footing the bill.

President Biden is desperate to bring young people back into his coalition, and this rule appears to be a handout to attract these voters. The losers in the proposal are taxpayers and everyone who passed on college or managed their student loan debt responsibly. Congress should pass the REINS Act to help prevent bad rules like this from taking effect.

IDR plans have become more popular in the last decade

IDR plans became available to student loan borrowers in 1995 with the Federal Family Education Loan.6 The federal government now offers four different IDR options for borrowers.7 The Revised Pay As You EARN (REPAYE) Plan, which the proposed rule would transform, is one of these and was only created in 2016.8

These plans were designed to help borrowers work to pay off their loans early in their careers when their debt-to-income ratio may be high. In early 2023, there were more than 8.5 million borrowers enrolled in an IDR plan.9 This was up from only 1.6 million in June 2013.10 Borrowers in an IDR plan owed $538 billion on their student loans.11 And the total student loan universe includes nearly 44 million borrowers with more than $1.6 trillion in debt.12

For borrowers in the REPAYE Plan, the most popular IDR plan, the Biden administration’s proposed rule does not only tinker with their plan, but it would also overhaul it by implementing major changes.13

The Biden administration’s proposed rule would allow borrowers to shift their debt onto taxpayers

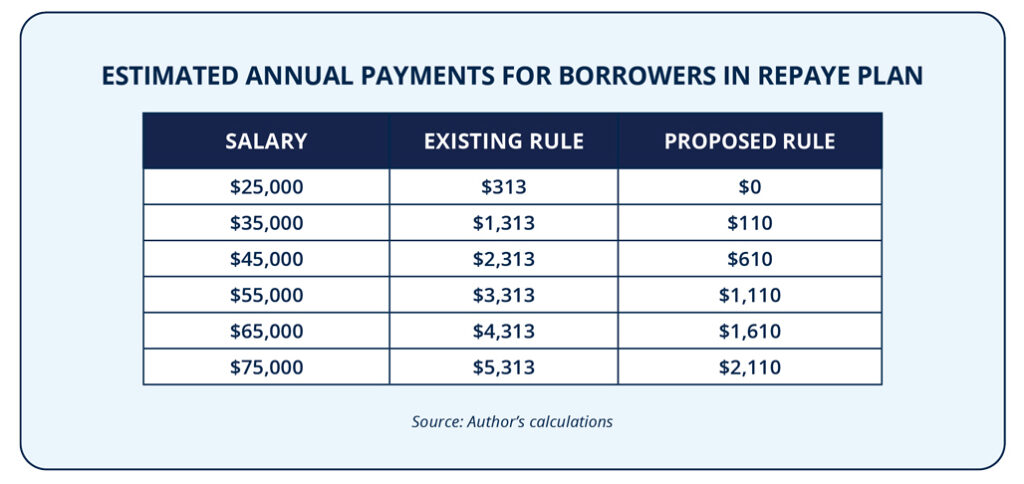

The proposed rule would raise the amount of income that is considered non-discretionary, meaning it would be exempted from the borrower’s income when establishing repayment rates. Under the existing rule, income up to 150 percent of the federal poverty level is exempted, and the new rule would raise this up to 225 percent of the federal poverty level.14 For 2023, this is roughly equivalent to $33,000.15 If the proposed rule is implemented, some people making more than twice the poverty level would no longer need to make any repayments on their student loans.

Equally significant, the rule would cut the amount of discretionary income that borrowers must pay back each month in half, from 10 percent to five percent.16 These two changes are the drivers that would reduce borrowers’ payments and ultimately shift their debt onto taxpayers. For example, under existing rules, a person making $40,000 a year would make monthly payments of $151 to service his or her debt, but under the proposed rules the new payment would be only $30.17

Compounding the reduced payments, the proposed rule would also transfer loan balances to taxpayers after 10 years instead of 20 years for certain borrowers.18 For those who originally borrowed $12,000 or less their loans would be taken over by taxpayers after 10 years with one additional year added for every additional $1,000 borrowed, capped at 20 years.19

These changes would allow some borrowers to pass their student loan debts onto taxpayers without paying back a single dime of the thousands of dollars they borrowed. For all others, it would result in vastly reduced payments by the benefactors of a college education and an additional burden on the public at large.

The Biden administration’s proposed rule would cover borrowers’ unpaid monthly interest even if their required payment is $0.20 This is convenient for the borrower, as their total debt would not increase even if their payments were so small that they do not even cover the interest on their debt.

But this unpaid interest does not stop accruing, and the bill would just be sent to taxpayers instead of the borrower. With federal student loan interest rates of five to 6.5 percent, this would be a massive transfer of debt from student loan borrowers to taxpayers.21

The proposal would also allow the Department of Education to pull income information automatically from borrowers so they would no longer need to recertify their repayment plan annually.22 This means that more borrowers would stay in the REPAYE Plan, which is cheaper for them but more costly for taxpayers.

Finally, the Biden administration would phase out other forms of IDR plans.23 Borrowers would instead be grouped into the transformed REPAYE Plan, meaning eventually taxpayers would cover the debts of even more college attendees.

The new repayment plan would cost taxpayers billions and would create bad incentives

All told, the proposed rule would be extremely costly. The Department of Education itself estimates that the rule would come at a cost of $138 billion.24 The Congressional Budget Office estimates that the rule would be even more costly at $230 billion.25

But the true cost of the rule would likely be much higher because these estimates assume static usage of the REPAYE Plan. More borrowers are likely to opt into this plan as it requires lower payments and forgives debts sooner. Also, borrowers are likely to take out greater amounts of loans knowing they likely will not be required to pay the full amount back.

Right now, 45 percent of all undergraduates and 77 percent of community college students do not take out any loans.26 With the updated REPAYE Plan, that shifts the debt burden from borrowers to taxpayers, many of these students are likely to take out loans in the future. Likewise, in 2016, undergraduates left $105 billion in available loans on the table and graduate students left an additional $79 billion in loans unused.27 With the substantial discount offered by the REPAYE Plan, students will likely use a greater percentage of the loans made available to them.

Taking this into account, one estimate of the true cost of the rule lies between $332 and $360 billion.28 With an even greater take-up rate, the rule could cost upwards of $471 billion according to their model.29 This proposed rule could be even more costly than the Biden administration’s loan forgiveness plan because it is a program change and not a one-time transfer. The bad incentives could lead to the taking on of excess amounts of student loan debt.

The ongoing pause in loan repayments and interest accumulation during the COVID-19 pandemic shows what can happen when borrowers are no longer required to pay back their debts.30 Before the pause, just 2.7 million borrowers had their federal loans in forbearance, but by the end of 2021, that number rose to an astounding 24 million.31 These borrowers had loans totaling $968 billion, or 77 percent of the total federal loans held by individuals not enrolled in school.32

One estimate shows 20 percent of the typical undergraduate borrowers would not make any payments under the Biden administration’s proposed rule, and 78 percent would fail to pay off the entire loan.33 This is not the way to teach people to take debt seriously. It sets them up to fail when they take on other types of debt like car loans or a mortgage, which they will be expected to make full payments on or face default.

The real losers in this proposal are the students who worked during school to pay for their education or who paid back their loans responsibly after graduation—not to mention all the workers who did not enroll in college but would now be expected to pay off the debts of those who chose to attend.

The proposed rule does not touch the real issue: rising tuition costs

The reason that there is so much action on student loan debt right now is that the total debt load has been increasing so quickly. Since 2007, total student loan debt has more than tripled.34 The reason for the increasing amount of debt is that college tuition is also increasing. Adjusting for inflation, college tuition has more than tripled since the 1960s and more than doubled in the last 30 years.35-36

Much of the increasing costs are attributed to administrative costs rather than instructing students.37 Department of Education data shows that administrative positions increased by 60 percent from 1993 to 2009, 10 times the rate of tenured faculty positions.38 For example, the California State University system increased full-time faculty from 11,614 to 12,019 but administrators from 3,800 to 12,183 from 1975 to 2008.39

The proposed rule does not address these rising costs. Instead, it would incentivize increasing tuition further as students respond to decreased payments and easier debt forgiveness by applying for larger loans.

The REINS Act could stop costly rules like this in their tracks

To prevent costly rules that burden taxpayers from taking effect, Congress should reform the regulatory system. Federal lawmakers should ensure that major rules are not implemented through agency action alone, without congressional approval.

Congress can look to Florida as one example of how legislative oversight of rules can positively affect life for its citizens.40

Congress should pass the REINS Act, which would require rules with an annual price tag of $100 million or more to receive congressional approval before being implemented by agencies.41 This would allow the voters’ elected officials to stop expensive, harmful rules that unelected bureaucrats seek to put in place. It would also provide accountability to legislators by requiring them to take a vote on all major rules.

THE BOTTOM LINE: The Biden administration’s proposed rule would cost billions and leave taxpayers paying for the college tuition of millions of Americans. Congress should pass the REINS Act to stop costly rules like this before they go into effect.

The Biden administration’s proposed rule would cost billions and leave taxpayers paying for the college tuition of millions of Americans. Congress should pass the REINS Act to stop costly rules like this before they go into effect.

The Biden administration is desperate to bring young people back into the fold after seeing support from this core constituency plummet.42-45 The administration’s student loan forgiveness program faced headwinds in Congress before being thrown away completely by the Supreme Court.46-48 Transforming IDR plans from a way to help students work and reasonably pay back their loans to transferring these debts to taxpayers is the administration’s next attempt at attracting young voters.

But this plan would tag taxpayers with a large bill. It would punish hardworking Americans who either found a career without a college education or worked to responsibly pay back their student loans.

Worse still, the proposed rule would incentivize students to take on more debt that would be paid back by taxpayers—all this without putting any brakes on the rising tuition costs that are increasing the student debt load in the first place.

**This report was updated after the release of the Supreme Court decision in Biden v. Nebraska on 6/29/23 after initial publication on 6/27/23.

REFERENCES

1 Edward Conroy, “Biden administration to forgive up to $20,000 in student loans,” Forbes (2022), https://www.forbes.com/sites/edwardconroy/2022/08/24/biden-administration-to-forgive-up-to-20000-in.student-loans/?sh=2a4b67062df6.

2 Alli Fick and Haley Holik, “How lawmakers can rein in regulations like the student loan bailout,” Foundation for Government Accountability (2023), https://thefga.org/research/lawmakers-can-rein-in-regulations-like-student.loan-bailout/.

3 Annie Nova and Dan Mangan, “Federal appeals court blocks Biden student debt relief program nationwide,” CNBC (2022), https://www.cnbc.com/2022/11/14/biden-student-loan-debt-relief-plan-appeals-court-rules.html.

4 Amy Howe, “Biden’s student-loan forgiveness plan gets cold reception from conservative justices,” SCOTUSblog (2023), https://www.scotusblog.com/2023/02/bidens-student-loan-forgiveness-plan-gets-cold-reception-from.conservative-justices/.

5 Federal Register, “Improving Income-Driven Repayment for the William D. Ford Federal Direct Loan Program,” National Archives and Records Administration (2023),https://www.federalregister.gov/documents/2023/01/11/2022-28605/improving-income-driven-repayment-for.the-william-d-ford-federal-direct-loan-program.

6 The CFPB Office of Research, “Data point: Borrower experiences on Income-Driven Repayment,” Consumer Financial Protection Bureau (2019), https://files.consumerfinance.gov/f/documents/cfpb_data-point_borrower.experiences-on-IDR.pdf.

7 Federal Student Aid, “If your federal student loan payments are high compared to your income, you may want to repay your loans under an income-driven repayment plan,” United States Department of Education (2023), https://studentaid.gov/manage-loans/repayment/plans/income-driven.

8 Adam S. Minsky, “Biden announces new student loan plan: big details on forgiveness and payments,” Forbes (2023), https://www.forbes.com/sites/adamminsky/2023/01/10/8-big-new-details-on-bidens-latest-student-loan.repayment-plan-and-who-benefits-most/?sh=75c412241941.

9 Federal Student Aid, “Federal student loan portfolio,” United States Department of Education (2023), https://studentaid.gov/data-center/student/portfolio.

10 Navient, “FSA data center at a glance,” (2018), https://news.navient.com/static-files/3a9206f3-7b33-4022-aa46.970b95c986ea.

11 Federal Student Aid, “Federal student loan portfolio,” United States Department of Education (2023), https://studentaid.gov/data-center/student/portfolio.

12 Ibid.

13 Eliza Haverstock, et al., “Student loan debt statistics: 2023,” NerdWallet (2023), https://www.nerdwallet.com/article/loans/student-loans/student-loan-debt.

14 Federal Register, “Improving Income-Driven Repayment for the William D. Ford Federal Direct Loan Program,” National Archives and Records Administration (2023), https://www.federalregister.gov/documents/2023/01/11/2022-28605/improving-income-driven-repayment-for.the-william-d-ford-federal-direct-loan-program.

15 Office of the Assistant Secretary for Planning and Evaluation, “2023 poverty guidelines: 48 contiguous states (all states except Alaska and Hawaii),” United States Health and Human Services (2023), https://aspe.hhs.gov/sites/default/files/documents/1c92a9207f3ed5915ca020d58fe77696/detailed-guidelines.2023.pdf.

16 Federal Register, “Improving Income-Driven Repayment for the William D. Ford Federal Direct Loan Program,” National Archives and Records Administration (2023), https://www.federalregister.gov/documents/2023/01/11/2022-28605/improving-income-driven-repayment-for.the-william-d-ford-federal-direct-loan-program.

17 Author’s calculations where under the existing rule $18,130 would be considered discretionary income, with ten percent of discretionary income required to be paid back annually or $1,813, equating to $151 per month. Under the new rule, $7,195 would be considered discretionary income, with five percent of discretionary income required to be paid back annually or $360, equating to $30 per month.

18 Federal Register, “Improving Income-Driven Repayment for the William D. Ford Federal Direct Loan Program,” National Archives and Records Administration (2023), https://www.federalregister.gov/documents/2023/01/11/2022-28605/improving-income-driven-repayment-for.the-william-d-ford-federal-direct-loan-program.

19 Ibid.

20 Ibid.

21 Federal Student Aid, “Interest rates and fees for federal student loans,” United States Department of Education (2023), https://studentaid.gov/understand-aid/types/loans/interest-rates.

22 Federal Register, “Improving Income-Driven Repayment for the William D. Ford Federal Direct Loan Program,” National Archives and Records Administration (2023), https://www.federalregister.gov/documents/2023/01/11/2022-28605/improving-income-driven-repayment-for.the-william-d-ford-federal-direct-loan-program.

23 Ibid.

24 Ibid.

25 Congressional Budget Office, “Costs of the proposed Income-Driven Repayment plan for student loans,” United States Government (2023), https://www.cbo.gov/publication/58983.

26 Preston Cooper, “Biden’s quiet student loan cancellation: Income-Driven Repayment expansion,” Forbes (2023), https://www.forbes.com/sites/prestoncooper2/2023/01/11/bidens-quiet-student-loan-cancellation-income.driven-repayment-expansion/?sh=3cf6ce48f4b0.

27 Adam Looney, “Biden’s Income-Driven Repayment plan would turn student loans into untargeted grants,” Brookings (2022), https://www.brookings.edu/opinions/bidens-income-driven-repayment-plan-would-turn.student-loans-into-untargeted-grants/.

28 Budget Model, “Budgetary cost of newly proposed Income-Driven Repayment plan,” Penn-Wharton (2023), https://budgetmodel.wharton.upenn.edu/issues/2023/1/30/budgetary-cost-of-proposed-income-driven.repayment.

29 Ibid.

30 Federal Student Aid, “COVID-19 emergency relief and federal student aid,” United States Department of Education (2023), https://studentaid.gov/announcements-events/covid-19.

31 Alicia Hahn, “2023 student loan debt statistics: Average student loan debt,” Forbes (2023), https://www.forbes.com/advisor/student-loans/average-student-loan-debt-statistics/.

32 Author’s calculation, $968 billion in debt in forbearance of a total of $1.25 trillion debt for borrowers who are out of school, based on data from Alicia Hahn, “2023 student loan debt statistics: Average student loan debt,” Forbes (2023), https://www.forbes.com/advisor/student-loans/average-student-loan-debt-statistics.

33 Matthew Chingos, et al., “Few college students will repay student loans under the Biden administration’s proposal,” Urban Institute (2023), https://www.urban.org/sites/default/files/2023.01/Few%20College%20Students%20Will%20Repay%20Student%20Loans%20under%20the%20Biden%20Administr ations%20Proposal.pdf.

34 Elizabeth Kerr, “US students’ loans tripled in the last 15 years to stand at $1.75T,” Money Transfers (2023), https://moneytransfers.com/news/2022/04/21/us-students-loans-tripled-in-the-last-15-years-to-stand-at-1-75t.

35 Jessica Bryant, “Cost of college over time: Rising tuition statistics,” Best Colleges (2023), https://www.bestcolleges.com/research/college-costs-over-time/.

36 Emmie Martin, “Here’s how much more expensive it is for you to go to college than it was for your parents,” CNBC (2017), https://www.cnbc.com/2017/11/29/how-much-college-tuition-has-increased-from-1988-to.2018.html.

37 LaMont Jones Jr., “One culprit in rising college costs: Administrative expenses,” U.S. News & World Report (2023), https://www.usnews.com/education/articles/one-culprit-in-rising-college-costs.

38 Paul F. Campos, “The real reason college tuition costs so much,” The New York Times (2015), https://www.nytimes.com/2015/04/05/opinion/sunday/the-real-reason-college-tuition-costs-so-much.html.

39 Ibid.

40 Haley Holik, “How legislative and executive oversight helps Florida cut and control red tape,” Foundation for Government Accountability (2023), https://thefga.org/research/legislative-executive-oversight-helps-florida-cut.control-red-tape/.

41 FGA, “Stop giving bureaucrats free rein,” Foundation for Government Accountability (2023), https://thefga.org/reins-act/.

42 Geoffrey Skelley, “How Biden lost the support of young Americans,” FiveThirtyEight (2022), https://fivethirtyeight.com/features/how-biden-lost-the-support-of-young-americans/.

43 Jeffrey M. Jones, “Biden job approval down most among younger generations,” Gallup (2022), https://news.gallup.com/poll/391733/biden-job-approval-down-among-younger-generations.aspx.

44 Michael Levitt, “Polls show Biden is losing support from Gen Z. These young voters aren’t surprised,” NPR (2022), https://www.npr.org/2022/05/01/1095466871/biden-polls-democrats-gen-z-midterms.

45 Emily Crane, “Biden’s approval rating drops among young Americans to 36%: Poll,” New York Post (2023), https://nypost.com/2023/04/24/bidens-approval-rating-drops-among-young-americans-to-36-poll/.

46 Greg Stohr, “Supreme Court voices doubt on Biden student-loan relief plan,” Bloomberg Law (2023), https://news.bloomberglaw.com/us-law-week/supreme-court-questions-biden-student-loan-relief-worth-billions.

47 Kamaron McNair, “Senate votes to overturn Biden’s student debt forgiveness and end the payment pause— what borrowers need to know,” CNBC (2023), https://www.cnbc.com/2023/05/26/house-passes-bill-blocking.student-debt-forgiveness.html.

48 Lexi Lonas, “Senate passes measure to halt Biden’s student debt forgiveness,” The Hill (2023), https://thehill.com/homenews/education/4030071-senate-passes-measure-to-halt-bidens-student-debt.forgiveness/.