Congress Should Rein in Regulation and Close the Loopholes in Administrative PAYGO

Key Findings

- The Biden administration has finalized 724 new regulations in its first three years at a cost of nearly $435 billion.

- Congress took a step to cut down on excessive regulation by passing a Pay-As-You-Go (PAYGO) provision which requires that new regulations be offset by spending cuts.

- The provision has loopholes that agencies will exploit to continue to rack up regulatory spending.

- Congress can take action to rein in excessive regulation by closing the loopholes.

Overview

In our system of limited government, Congress is supposed to hold the power of the purse and have the sole authority to authorize spending and the collection of taxes. This is one of the primary ways that Congress exercises oversight of the executive branch and prevents the consolidation of power. However, the executive branch has become a sprawling bureaucracy of more than 400 agencies and sub-agencies staffed by unelected bureaucrats who create new regulations for the American people to follow.1 These regulations also have resulted in increased spending for existing programs without the authorization of Congress or the approval of the American people.2

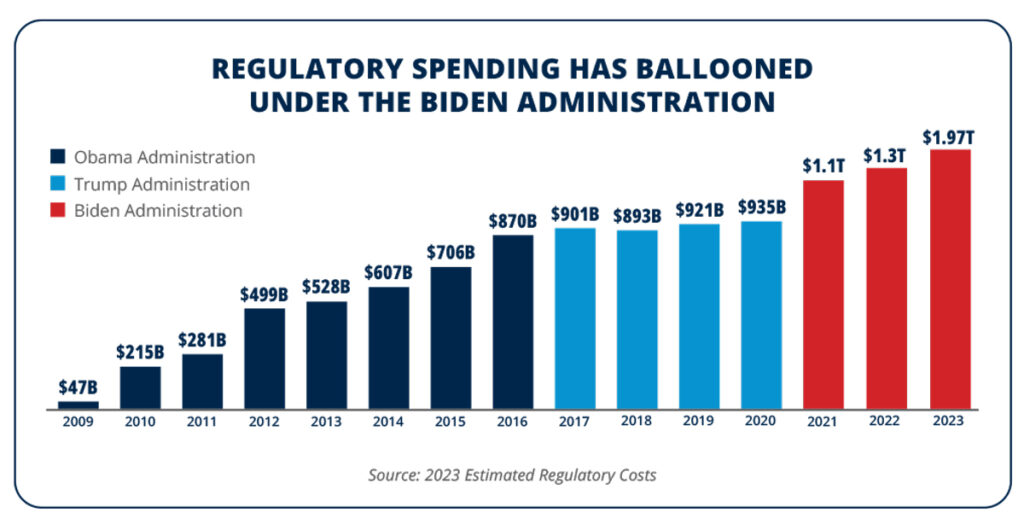

Over the last three years, the Biden administration has been on a regulatory spending spree, racking up billions in new spending and stifling economic growth with the costs of compliance.3 In the first three years alone, the Biden administration finalized 724 regulations and an additional 311 are in the rulemaking process.4

President Biden has increased spending through regulation more than any other president, spending close to $435 billion so far.5 Other recent examples of regulatory spending that go beyond the billions already spent include:

- Regulations issued to change the way that income-driven student loan repayments are calculated are expected to cost $475 billion in the first 10 years, and billions more beyond that window.6-7

- In 2021, the U.S. Department of Agriculture abused regulatory power to change the way that food stamp benefits are calculated.8 This unilateral expansion of welfare will cost up to $250 billion in the first 10 years alone.9

- In 2022, the Centers for Medicare & Medicaid Services (CMS) proposed a regulation that would hamper states’ ability to conduct redeterminations of Medicaid eligibility.10 The rule is projected to cost at least $100 billion.11

Beyond increasing direct government spending on programs such as food stamps or student loans, regulations cost the economy billions of dollars from compliance costs for businesses, lost jobs and productivity, and the costs of implementation and enforcement within the federal bureaucracy.12

As of 2020, before the Biden administration’s drastic expansion of the regulatory state, it cost the government $80 billion annually simply to write and enforce regulations that impact the private sector, excluding regulations issued by agencies such as the Department of Defense and CMS.13 This is 17 times the cost of writing and enforcing regulations in 1960.14 Some efforts are more expensive than others. For example, in 2020 it cost $8.7 billion to create and enforce environmental regulations alone.15

Studies have demonstrated that regulations decrease corporate profitability and stifle competition and growth.16 Americans spend more than 10 billion hours each year on regulatory compliance, at a cost of more than $140 billion annually.17 The total cost of regulations to the economy has risen to nearly $2 trillion annually.18

The Trump administration, by comparison, prioritized deregulation over expanding the regulatory state. President Trump issued an executive order that required agencies to cut two regulations for every new rule that was finalized and required agencies to offset new regulatory spending.19 While agencies sometimes did not abide by this policy, the deregulatory efforts made a dent, and the cumulative cost of regulations from 2017-2020 was nearly flat.20 It is possible to slow the growth of regulatory spending and allow the free market economy to flourish.

Congress is trying to stem the tide of excessive regulation but loopholes remain

In the debt ceiling agreement passed in May 2023, known as the Fiscal Responsibility Act, Congress included a provision called statutory Administrative Pay-As-You-Go (PAYGO), which requires discretionary regulations that increase direct government spending by $1 billion over 10 years or by $100 million in one year to be offset by spending cuts.21 Discretionary regulations are those not required by law or when the agency has leeway in implementation, and direct government spending means spending that is mandated by law.22 So, when agencies push discretionary regulations that increase direct spending, Congress does not control how much can be spent via annual appropriations.23

Without Administrative PAYGO or another policy to limit how new regulations can increase spending on mandatory programs, the Biden administration has a blank check to keep spending taxpayer dollars through regulatory schemes.24 The Administrative PAYGO policy included in the Fiscal Responsibility Act is a step in the right direction, and in theory, should require the Biden administration to offset new taxpayer spending.25

Unfortunately, the provision has three pitfalls that gut the effectiveness of the policy

First, the PAYGO provision expires at the end of 2024.26 This means that following the expiration of the policy, executive agencies will once again have a license to unleash federal spending through regulation without restraint.

Second, the bill allows for the Office of Management and Budget (OMB) to waive the PAYGO requirement.27 The reasons for a waiver are vague and expansive, such as a new regulation being “necessary for effective program delivery.”28 Congress does not get a say if a waiver is granted, and the sole authority lies with the Director of OMB who is a political appointee of the president.29 This effectively means that the Biden administration can waive the PAYGO requirement for any new spending for any reason.

Before the bill was even signed into law, the Director of OMB said that her office would waive the PAYGO requirement if doing so was necessary to implement President Biden’s agenda.30 Within weeks of the PAYGO provision becoming law, the same office issued guidance to agencies instructing them on all of the exemptions and how to get a waiver before considering actually finding ways to pay for new spending.31 The Director of OMB’s commitment to waive PAYGO came to fruition just a few months later when OMB allowed the Department of Education to increase spending on student loan programs by $475 billion with no offset.32

Third, there is no judicial review, which means that there is no accountability for agencies that flout the requirement and issue expensive new regulations without offsetting spending.33 While the executive branch is tasked with enforcing laws passed by Congress, a healthy system of government depends on the judicial branch of government and Congress having a way to ensure that executive agencies are following the law.

Even in cases where the broad waiver authority is not used, it will be difficult for Congress to hold agencies accountable. OMB’s guidance to agencies on implementing the PAYGO provision asserts that rule-makers are not required to move forward with or implement the offsets that they identify.34 Agencies can claim to comply with the rule by simply identifying ways to reduce spending, without actually doing so.35

These loopholes in Administrative PAYGO are broad and make the policy toothless. However, Congress can act to limit the expansion of the regulatory burden in a meaningful way.

Congress should take action to rein in excessive regulation

In the next spending bill, Congress should close the loopholes in Administrative PAYGO to make the policy effective in its goal to limit new spending.

First, Congress can act to make the provision permanent, instead of expiring in 2024. This would ensure that all future administrations must find offsets for new spending. Second, Congress should eliminate the waiver. The current language allows a waiver for virtually any reason.36 Eliminating the waiver would ensure that new costly regulations would actually be paid for. Third, Congress should subject agency noncompliance to judicial review. This will ensure that agencies are held accountable for a failure to offset new spending.

While fixing Administrative PAYGO is an important step to true fiscal responsibility, Congress can go even further to ensure that the executive branch is held accountable to the American people by passing the REINS Act. The REINS Act would require Congress to approve new regulations with an annual price tag of $100 million or more before they can take effect.37 This would bring accountability to the regulatory process and ensure that new regulations that would have a sweeping impact on the economy and the American people also had the support of Congress.38 The REINS Act would help stop overly burdensome regulations from ever being implemented, saving billions in compliance costs.39

The Bottom Line: Excessive regulation costs taxpayers billions, and Congress should put a stop to it by fixing Administrative PAYGO and passing the REINS Act.

Regulations cost taxpayers trillions of dollars. From the cost of expanding programs well beyond congressional intent, to the cost of bureaucratic salaries to enforce new regulations, to the cost on businesses to comply, regulations are a drain on the economy. The Biden administration is on a runaway regulatory spending spree, but Congress is not powerless to stop it.

While the Administrative PAYGO requirement in the Fiscal Responsibility Act was a step toward accountability and restraint, the loopholes in the policy give the Biden administration license to continue regulatory overreach at an unprecedented pace. Congress should fix the loopholes in Administrative PAYGO and pass the REINS Act to slow down regulation and achieve true fiscal responsibility.

References

1 General Services Administration, “A-Z index of government departments and agencies,” General Services Administration (2023), https://www.usa.gov/agency-index.

2 Michael Greibrok, “How Congress can rein in Biden bureaucrats spending spree,” Foundation for Government Accountability (2023), https://thefga.org/research/how-congress-can-rein-in-biden-bureaucrats-spending-spree.

3 Ibid.

4 American Action Forum, “Regulation rodeo,” American Action Forum (2023), https://regrodeo.com/.

5 Ibid.

6 J.D. Tuccille, “Biden’s latest student loan scheme has a bigger price tag than originally projected,” Reason (2023), https://reason.com/2023/07/19/bidens-latest-student-loan-scheme-has-a-bigger-price-tag-than-originally-projected/.

7 Michael Greibrok, “President Biden’s proposed student loan rule would cost taxpayers billions,” Foundation for Government Accountability (2023), https://thefga.org/research/proposed-student-loan-rule-cost-billions.

8 Jonathan Bain, “Freezing the Thrifty Food Plan: How Congress can reverse course after the Biden administration’s unlawful food stamp expansion,” Foundation for Government Accountability (2023), https://thefga.org/research/freezing-the-thrifty-food-plan.

9 Ibid.

10 Jonathan Bain and Sam Adolphsen, “Maximize enrollment, weaken program integrity: How the Biden administration’s proposed Medicaid rule would decimate an already broken program,” Foundation for Government Accountability (2022), https://thefga.org/research/maximize-enrollment-weaken-program-integrity.

11 Ibid.

12 Alli Fick et al., “Congress must rein in Biden’s regulatory spending spree to tame inflation,” Foundation for Government Accountability (2023), https://thefga.org/research/congress-must-rein-spending-to-tame-inflation.

13 Mark Febrizio and Melinda Warren, “Regulators’ budget: Overall spending and staffing remain stable,” Regulatory Studies Center at the George Washington University (2020), https://regulatorystudies.columbian.gwu.edu/regulators-budget-overall-spending-and-staffing-remain-stable.

14 Ibid.

15 Ibid.

16 Daphne M. Armstrong et al., “Measuring corporate regulation,” National Bureau of Economic Research (2023), https://conference.nber.org/conf_papers/f176581.pdf.

17 Alli Fick et al., “Congress must rein in Biden’s regulatory spending spree to tame inflation,” Foundation for Government Accountability (2023), https://thefga.org/research/congress-must-rein-spending-to-tame-inflation.

18 Clyde Wayne Crews, “Chapter 3: What comes after “trillion”? The unknowable costs of regulation and intervention,” Competitive Enterprise Institute (2022), https://cei.org/publication/chapter-3-10kc-2022/.

19 Executive Order 13771 (2017), https://www.federalregister.gov/documents/2017/02/03/2017-02451/reducing-regulation-and-controlling-regulatory-costs.

20 American Action Forum, “Regulation rodeo,” American Action Forum (2023), https://regrodeo.com/.

21 House Committee on Budget, “H.R. 3746, The Fiscal Responsibility Act of 2023: Frequently asked questions,” House of Representatives (2023), https://budget.house.gov/resources/staff-working-papers/hr-3746-the-fiscal-responsibility-act-of-2023-frequently-asked-questions.

22 Ibid.

23 Ibid.

24 Ibid.

25 Ibid.

26 Public Law 118-5 (2023), https://www.congress.gov/118/plaws/publ5/PLAW-118publ5.pdf.

27 Ibid.

28 Ibid.

29 Shalanda Young, “Guidance for implementation of the Administrative Pay-As-You-Go Act of 2023,” Office of Management and Budget (2023), https://www.whitehouse.gov/wp-content/uploads/2023/09/M-23-21-Admin-PAYGO-Guidance.pdf.

30 Tim Hains, “OMB Director Young: Administration will waive PAYGO requirement whenever ‘deemed necessary’,” Real Clear Politics (2023), https://www.realclearpolitics.com/video/2023/05/30/omb_director_young_administration_will_waive_paygo.html.

31 Shalanda Young, “Guidance for implementation of the Administrative Pay-As-You-Go Act of 2023,” Office of Management and Budget (2023), https://www.whitehouse.gov/wp-content/uploads/2023/09/M-23-21-Admin-PAYGO-Guidance.pdf.

32 Department of Education, “Improving income-driven repayment for the William D. Ford Federal Direct Loan Program and the Federal Family Education Loan (FFEL) Program,” Federal Register 88(130): 43820-43905 (2023), https://www.govinfo.gov/content/pkg/FR-2023-07-10/pdf/2023-13112.pdf.

33 Public Law 118-5 (2023), https://www.congress.gov/118/plaws/publ5/PLAW-118publ5.pdf.

34 Shalanda Young, “Guidance for implementation of the Administrative Pay-As-You-Go Act of 2023,” Office of Management and Budget (2023), https://www.whitehouse.gov/wp-content/uploads/2023/09/M-23-21-Admin-PAYGO-Guidance.pdf.

35 Ibid.

36 Tim Hains, “OMB Director Young: Administration will waive PAYGO requirement whenever ‘deemed necessary’,” Real Clear Politics (2023), https://www.realclearpolitics.com/video/2023/05/30/omb_director_young_administration_will_waive_paygo.html. 37 Brianna Herlihy, “GOP planning bill to curb ‘silent killer’ of the American dream, federal regulations,” Fox News (2023), https://www.foxnews.com/politics/gop-planning-bill-curb-silent-killer-american-dream-federal-regulations.

38 Ibid.

39 Ibid.