Medicaid Mismanagement: How States Can Restore Integrity to the Program While Saving Taxpayers Billions

KEY FINDINGS

- The Medicaid program was designed to provide a safety net for the truly needy.

- Over the last two decades, the program has ballooned in size and strayed from its original purpose.

- Today, Medicaid enrollment is at an all-time high, and improper payments are costing taxpayers billions.

- Making matters worse, the Biden administration has proposed rules that would severely limit the ability of states to conduct eligibility checks.

Overview

The Medicaid program was created to provide a safety net for truly needy Americans and was meant to be limited in nature.1 As a result, program eligibility was intended only for low-income children, pregnant women, individuals with disabilities, and seniors.2 But over the years, Medicaid eligibility requirements have been expanded countless times, causing the program to balloon in size.3

Nationwide, the Medicaid program is reeling. Rather than prioritizing the truly needy, the program’s focus has now shifted towards maximizing enrollment, no matter the cost.4 Unsurprisingly, enrollment hit an all-time high of 100 million in March 2023—nearly tripling over the last two decades.5

Unfortunately, program integrity has not kept pace with enrollment growth. This has resulted in waste, fraud, and abuse permeating throughout the Medicaid program.6 Improper Medicaid payments are skyrocketing, and more than one in five dollars spent was improper in 2021.7 Worse yet, the truly needy have been pushed to the back of the line.

While the situation is already dire, things are about to get much worse. The Biden administration proposed a rule that would require all states to implement more of the lax procedures that have that have led to soaring improper payment rates.8

The Medicaid program is full of waste, fraud, and abuse

Over the last two decades, the Medicaid program has grown exponentially. Unfortunately, program integrity measures have not kept pace with this growth, which has led to rampant waste, fraud, and abuse throughout the program.9

According to the Centers for Medicare & Medicaid Services (CMS), improper Medicaid payments cost taxpayers nearly $81 billion in 2022.10 Of these improper payments, the vast majority—87 percent—were due to insufficient documentation or eligibility errors.11

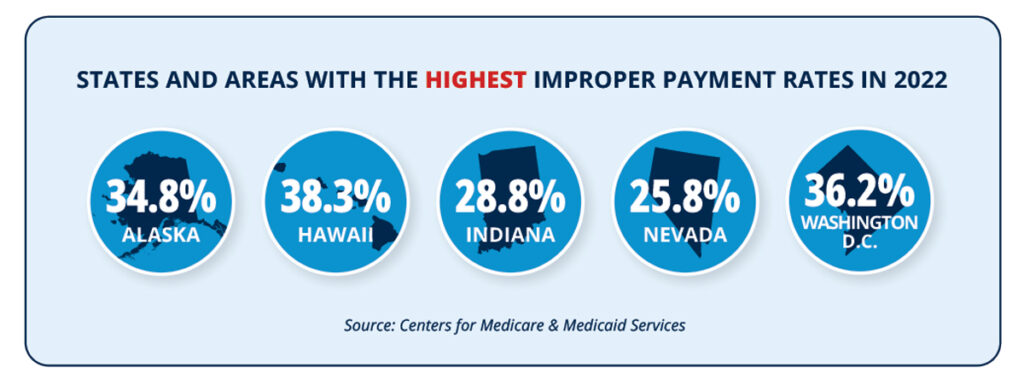

To determine improper payment rates, an audit is conducted and states are reviewed once every three years.12 Among the reporting states and areas with the highest improper payment rates in 2022 were Alaska (34.8 percent), Hawaii (38.3 percent), Indiana (28.8 percent), Nevada (25.8 percent), and Washington, D.C. (36.2 percent).13 States like Florida, Iowa, Mississippi, South Dakota, and Texas boasted some of the lowest improper payment rates for the cycle, which is unsurprising, considering their efforts to codify strong program integrity measures for their Medicaid programs.14

State and federal auditors have tried to uncover some of the long-running problems plaguing the Medicaid program—namely, ensuring those receiving benefits actually meet eligibility standards.15 In California, auditors discovered that more than 4.3 million enrollees were ineligible.16 New York came to a similar conclusion and determined that more than one million enrollees were potentially ineligible.17

Even more shocking, auditors identified tens of thousands of enrollees receiving benefits in multiple states at the same time.18 Worse yet, Arkansas and New Jersey officials found tens of thousands of enrollees with high-risk identities, and many had fraudulent Social Security numbers.19

The congressional handcuffs placed on states for years were a primary driver of the Medicaid enrollment surge.20 As part of the Families First Coronavirus Response Act, Congress provided states with a small, temporary increase in federal funding.21 In exchange, states were barred from removing anyone from the program—even people who were ineligible or had committed fraud.22 As a result, millions of ineligible enrollees were on the program, and states had no tools at their disposal to mitigate the problem.23

Though the Medicaid handcuffs have been unlocked, the Biden administration has encouraged states to take their time with the redetermination process.24 Federal bureaucrats have even encouraged states to take longer than a year to finish the process.25

The public health emergency showed that when redeterminations are infrequent, enrollment skyrockets, and improper payment rates soar. But President Biden has proven that program integrity is not a priority of his administration and has doubled down by proposing new rules that require states to implement even more lax program integrity procedures.26

The Biden administration’s proposed rule would only make things worse

In 2012, the Obama administration proposed rules that limited the ability of states to perform redeterminations in Medicaid.27 For certain eligibility groups, states were only allowed to perform redeterminations once annually.28 Now, the Biden administration is proposing a rule that would expand these restrictions to all eligibility groups.29

Currently, states are required to conduct redeterminations on Medicaid enrollees once a year—a commonsense safeguard, as life circumstances may change throughout the year.30 But the Biden administration is proposing to make the current minimum the new maximum, limiting the ability of states to ensure program integrity.31

The proposed rule goes a step further by severely limiting how states can perform redeterminations and verify eligibility. For example, states would be banned from performing face-to-face interviews for eligibility checks, despite the rise of identity fraud in welfare.32

The rule would also force states to keep ineligible cases open for months as part of a “reconsideration period,” and compel states to accept late, outdated information from applicants to determine eligibility.33 The ability of states to verify information—such as address or citizenship—would be severely impaired.34 Even worse, states would not be allowed to request follow-up information if financial data indicates an applicant could be ineligible.35

The Biden administration’s proposed rule would make it even more difficult for states to manage their Medicaid programs, and taxpayers will be left to foot the bill. Indeed, the Medicaid program is currently on pace to have $1 trillion in improper payments over the next decade.36 Fortunately, states still have options at their disposal.

The solution: commensense program integrity measures

The Medicaid program was designed to serve the truly needy and most vulnerable, but as the program has expanded, so has the waste, fraud, and abuse that are costing taxpayers billions. Despite the lack of support from federal lawmakers and the Biden administration, there are still commonsense safeguards that state lawmakers can employ to help solve the Medicaid problem.

States should begin cross-checking data between welfare programs to find inconsistencies and identify ineligible enrollees. This information already exists, and states have the data, so lawmakers should require state agencies to communicate and share this information. Information, such as tax records, death records, and incarceration records, are stored by the state, but rarely does the Medicaid program cross-check an enrollee’s information with other types of data stored in a separate department.

To mitigate fraud, states should initiate temporary lockout periods for enrollees abusing the system. This would not impact the truly needy, but rather temporarily ban able-bodied adults from receiving benefits if needed.

Other state welfare programs require enrollees to report changes in life circumstances, but Medicaid programs often do not. For example, state officials check lottery winners for some welfare programs but not all. States should require Medicaid enrollees to report life changes that could impact eligibility and cross-check lottery winners with enrollees to determine eligibility.

These commonsense solutions have a proven track record. In Arkansas, 80,000 ineligible enrollees were removed from the program—25,000 of whom were receiving benefits in multiple states.37 In Michigan, a $4 million jackpot winner was removed from welfare days after winning the lottery.38 And in Illinois, state officials found that more than 14,000 enrollees had died as early as 1989 but were still collecting benefits.39

THE BOTTOM LINE: To restore integrity in the Medicaid program, state lawmakers must implement commonsense safeguards.

The Medicaid program is in shambles. Enrollment sits at an all-time high of 100 million, states are trying to recover from the millions of ineligible enrollees, and the Biden administration has proposed rules that would only make the situation worse.

While the outlook is bleak, there are steps that states can take now to regain control of their Medicaid programs. By codifying these commonsense program integrity solutions, states can turn the page on years of destructive policies and an unsupportive president.

References

1 Jonathan Bain and Sam Adolphsen, “Maximize enrollment, weaken program integrity: How the Biden administration’s proposed Medicaid rule would decimate an already broken program,” Foundation for Government Accountability (2022), https://thefga.org/research/maximize-enrollment-weaken-program-integrity.

2 Michael Greibrok, “Universal work requirements for welfare programs are a win for all involved,” Foundation for Government Accountability (2023), https://thefga.org/research/universal-work-requirements.

3 Jonathan Bain and Sam Adolphsen, “Maximize enrollment, weaken program integrity: How the Biden administration’s proposed Medicaid rule would decimate an already broken program,” Foundation for Government Accountability (2022), https://thefga.org/research/maximize-enrollment-weaken-program-integrity.

4 Ibid.

5 Jonathan Bain, “Busted budgets and skyrocketing enrollment: Why states should reject the false promises of Medicaid expansion,” Foundation for Government Accountability (2023), https://thefga.org/research/states-should.reject-false-promises-of-medicaid-expansion.

6 Jonathan Bain and Sam Adolphsen, “Maximize enrollment, weaken program integrity: How the Biden administration’s proposed Medicaid rule would decimate an already broken program,” Foundation for Government Accountability (2022), https://thefga.org/research/maximize-enrollment-weaken-program-integrity.

7 Centers for Medicare & Medicaid Services, “Federally-facilitated exchange improper payment rate less than 1% in initial data release,” U.S. Department of Health & Human Services (2022), https://www.cms.gov/newsroom/press.releases/federally-facilitated-exchange-improper-payment-rate-less-1-initial-data.release#:~:text=The%202022%20Medicaid%20improper%20payment,the%20result%20of%20insufficient%20docu mentation.

8 Jonathan Bain and Sam Adolphsen, “Maximize enrollment, weaken program integrity: How the Biden administration’s proposed Medicaid rule would decimate an already broken program,” Foundation for Government Accountability (2022), https://thefga.org/research/maximize-enrollment-weaken-program-integrity.

9 Ibid.

10 The improper payment rate for Medicaid was nearly 16 percent in 2022. Centers for Medicare & Medicaid Services, “Federally-facilitated exchange improper payment rate less than 1% in initial data release,” U.S. Department of Health & Human Services (2022), https://www.cms.gov/newsroom/press-releases/federally.facilitated-exchange-improper-payment-rate-less-1-initial-data.release#:~:text=The%202022%20Medicaid%20improper%20payment,the%20result%20of%20insufficient%20docu mentation.

11 Ibid.

12 Medicaid and CHIP Payment Access Commission, “Payment Error Rate Measurement (PERM),” Medicaid and CHIP Payment Access Commission, https://www.macpac.gov/subtopic/payment-error-rate-measurement-perm.

13 Centers for Medicare & Medicaid Services, “2021 Medicaid & CHIP improper payment data,” U.S. Department of Health & Human Services (2021), https://www.cms.gov/files/document/2021-medicaid-chip-supplemental.improper-payment-data.pdf-0.

14 Author’s review of state Medicaid program integrity laws.

15 Jonathan Bain and Sam Adolphsen, “Maximize enrollment, weaken program integrity: How the Biden administration’s proposed Medicaid rule would decimate an already broken program,” Foundation for Government Accountability (2022), https://thefga.org/research/maximize-enrollment-weaken-program-integrity.

16 Ibid.

17 Ibid.

18 Ibid.

19 Ibid.

20 Ibid.

21 Ibid.

22 Ibid.

23 Ibid.

24 Michael Greibrok, “How Congress and states can rein in Biden bureaucrats while protecting program taxpayers’ money and Medicaid program integrity,” Foundation for Government Accountability (2023), https://thefga.org/research/how-congress-states-can-rein-biden-bureaucrats.

25 Ibid.

26 Jonathan Bain and Sam Adolphsen, “Maximize enrollment, weaken program integrity: How the Biden administration’s proposed Medicaid rule would decimate an already broken program,” Foundation for Government Accountability (2022), https://thefga.org/research/maximize-enrollment-weaken-program-integrity.

27 Ibid.

28 Ibid.

29 Ibid.

30 Ibid.

31 Ibid.

32 Ibid.

33 Ibid.

34 Ibid.

35 Ibid.

36 Author’s calculations based upon the Congressional Budget Office’s ten-year projection for Medicaid spending and applying the current improper payment rate.

37 Foundation for Government Accountability, “Welfare program integrity,” Foundation for Government Accountability (2020), https://thefga.org/one-pagers/welfare-program-integrity.

38 Ibid.

39 Ibid.

40 Author’s calculations based on potential federal savings if Medicaid program eligibility errors were eliminated.