ObamaCare Isn’t Working, but Affordable Health Care Coverage Is Within Reach

The ObamaCare exchanges are a mess. With so many regulations dictating every little component of coverage, premiums have more than doubled since ObamaCare was implemented in 2014. Making everything worse is the single-risk pool that is distorted by massive government subsidies. These subsidies may hide the true cost of premiums for some enrollees, but anyone not eligible for subsidized coverage is left without affordable options. ObamaCare is anything but an “affordable” care act.

Does it have to be this way? No.

While there might not be political will for sweeping reform packages, the truth is, there are some easy changes that can lower health care coverage prices. And Congress would do well to embrace them.

A new report from the Foundation for Government Accountability (FGA) details one of those easy changes: the New Health Options Market, a separate and parallel risk pool designed to serve employees using Individual Coverage Health Reimbursement Arrangements, which we’ll simplify to ICHRAs, and individuals who want to buy plans directly from insurers.

ICHRAs allow employers to provide pre-tax cash benefits to employees that they can use to purchase their own health insurance. It gives employees more choices and more control. Unfortunately, employees with ICHRAs face the same sky-high premiums endemic to the individual market. Without changes, ICHRAs aren’t all that attractive.

To lower premiums, we need a parallel risk pool

On average, group market participants are a less risky bunch to insure than the traditional individual market enrollee. If they are to migrate to the individual market with their employer-provided ICHRA, they are going to need more affordable options. The way to bring about lower premiums is through a separate and parallel risk pool designed to serve employees using ICHRAS and individuals who want to purchase directly from insurers. A hallmark of this new risk pool would be a key change to one of the more onerous ObamaCare regulations—the three-to-one age band.

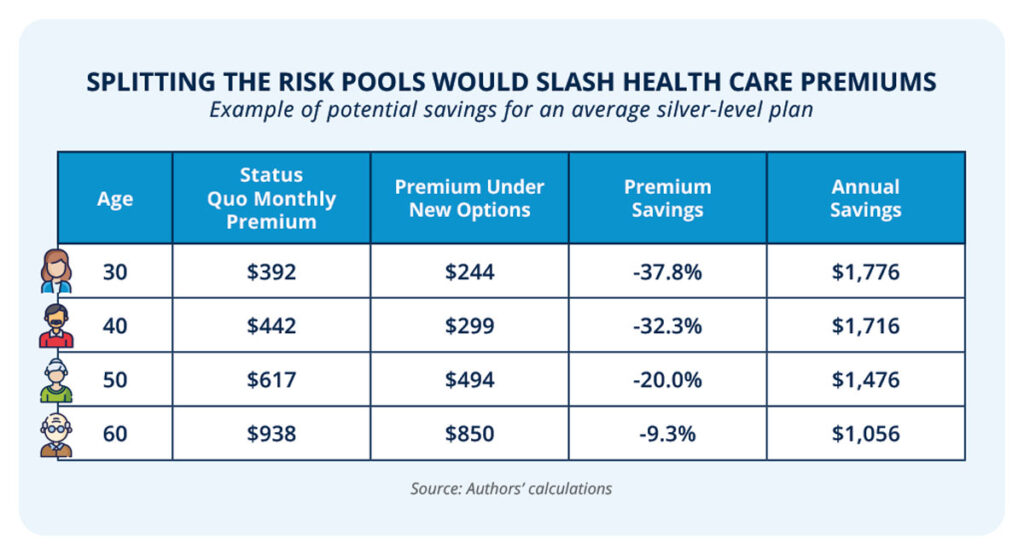

The three-to-one ratio for age-based premiums is one of the main drivers of sky-high premiums in the single-risk pool. This restriction makes it impossible for insurers to charge older and higher-cost enrollees more than three times what they can charge younger, low-risk buyers. Relaxing that to a five-to-one ratio would create more actuarially sound age bands and would reduce premiums for younger enrollees. The lower premiums for younger enrollees would attract more of them to the pool, putting even more downward pressure on premiums for all enrollees in all age bands.

Remember those pre-tax cash benefits we were just talking about? Well, for a family of four with an ICHRA, a separate risk pool designed this way could save them upwards of $6,200 per year!

But wait—there’s more (ways to save money)!

A reinsurance program could help enrollees in the new risk pool see further savings.

Reinsurance programs work to lower premiums by spreading out the risk—and cost—of insurance across all participating insurers in a market. A previous reinsurance program that cost about $50 per enrollee per month was able to reduce premiums between six and 11 percent.

A new reinsurance program, set at a similar $50 per enrollee cost, with a $6 billion annual cap, would once again put downward pressure on premiums in the new risk pool and would be phased out once premium costs stabilized across the market.

Bottom Line: ObamaCare is a mess, but we have options

The status quo is untenable, and Americans are struggling to find affordable health coverage. We deserve new health options. Congress can deliver by opening a new pathway for consumers to select quality coverage options that we can obtain at a lower cost.