The Marriage Penalty in Food Stamps is a Myth

- BY FGA

Food stamps shouldn’t be a reason to avoid marriage because there is no “marriage penalty” in food stamps.

It’s a common myth that being married can prevent a couple from being eligible for food stamps due to combined incomes. A new research paper by the Foundation for Government Accountability (FGA) debunks this myth and highlights ways the food stamp program can be strengthened.

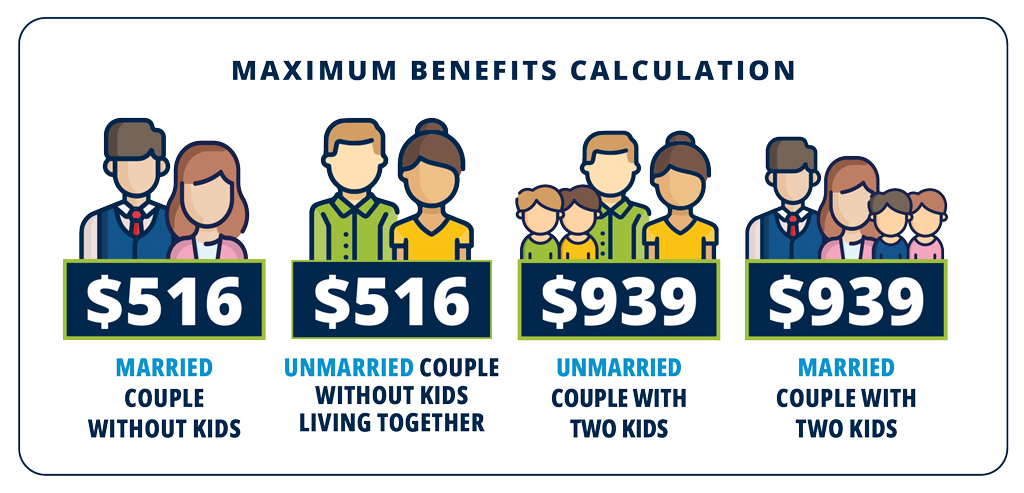

Your household, not your marital status, affects food stamp benefits. As the paper clarifies, the food stamp program is different from many other government programs in that benefits are distributed to households rather than individuals.

Federal law defines households in a few ways, but the common theme is individuals who live together and who purchase and prepare food together. So being married or unmarried doesn’t matter—your benefits are affected by the fact that you live under the same roof.

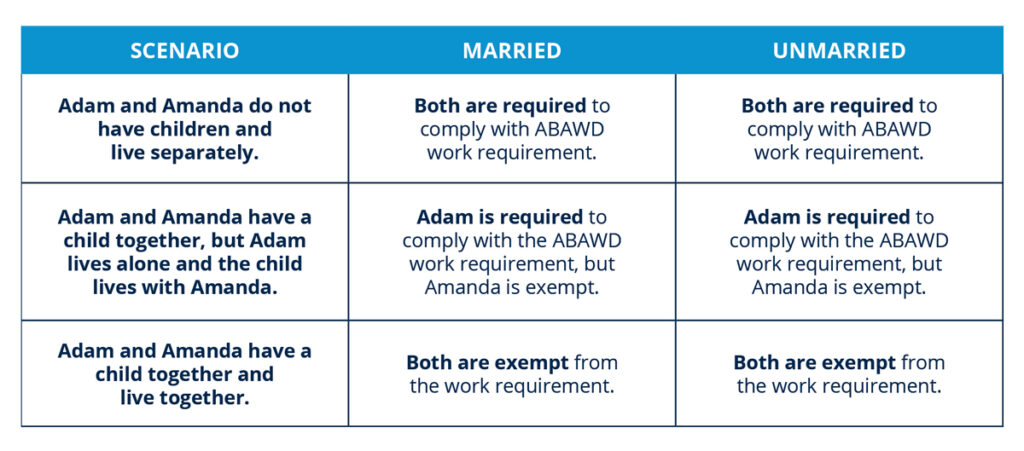

Marriage also has no impact on work requirements. Able-bodied adults without dependents (ABAWDs) under the age of 50 are subject to work requirements. If two ABAWDs move in together, they are both still subject to those work requirements, married or not. If they have a child together but live separately, the parent living with the child is exempt from the ABAWD work requirement, and the other is not. If the adults live together with their child, both adults are exempt from the ABAWD work requirement. Marriage has no direct impact on the broader, general work requirement, either. The general requirement expects adults up to age 59 with children older than six who do not already work 30 hours per week to participate in the state’s employment and training programs, if the state assigns them to one.

Couples Can Conceal Relationships—Fraud Prevention is a Must

Cohabitation—not marriage affects benefit levels. Because of this, there are some incentives for couples to artificially maintain multiple households as opposed to reporting that they are one household with a combined income. Couples hide the fact that they are cohabitating to continue receiving benefits they would otherwise be ineligible for as a household with their incomes combined. This is fraud. As the paper notes, the solution isn’t just about addressing the “marriage penalty” myth—it’s robust cross-checks and investigations to detect fraud and changes in food stamp enrollees’ eligibility.

If lawmakers want to encourage marriage and all the advantages that come from that stability, they should push back on the idea of a “marriage penalty” in food stamps and encourage robust changes to increase program integrity and strengthen work requirements. These changes will promote self-sufficiency and social mobility to those currently dependent on food stamps.