Four Myths About Medicaid Expansion Funding—And How to Debunk Them

THE BOTTOM LINE:

The promise of free Medicaid expansion money was never true—and remains a lie today.

Overview

Under the Affordable Care Act, more commonly known as ObamaCare, states were given the option to expand Medicaid to an entirely new class of able-bodied adults.1

Since 2014, many states have decided to expand, lured by the false promises of free federal funding and the economic boost that is supposed to follow.2

Today, the debate surrounding Medicaid expansion rages on, as 10 states continue to hold the line against massive welfare expansion.3 By doing so, these states are protecting their budgets, and more importantly, the truly needy. But as these states stand firm, proponents of expansion work to undercut their efforts. Expansion advocates often misrepresent data and Medicaid funding mechanisms to deceive states that stand in opposition.4

One of the primary falsehoods pushed by proponents is that expansion is good for a state because it supposedly “brings back” tax dollars that the state sends to the federal government—implying that they have a right to it.5 Expansion advocates also claim that by rejecting Medicaid expansion, states are sending their tax dollars to other states instead—a claim that is unequivocally false.6 Advocates continue to try to convince states that they can do nothing to reduce the national debt—and even worse, assert that expansion is essentially a free program that is fully funded by the federal government.7

In reality, all of these arguments put forth by proponents drastically misrepresent how Medicaid expansion is actually funded—and the threat that expansion poses to state budgets nationwide.

Myth #1: By expanding Medicaid, states are “bringing their tax dollars home.”

Reality: States already receive more federal funding than they pay in federal taxes.

Since the debate over whether to expand Medicaid began, advocates have long claimed that rejecting expansion means rejecting their state taxpayers’ dollars, and that states would be foolish to do so. This suggests that states are sending more money to Washington, D.C. than they receive in return.

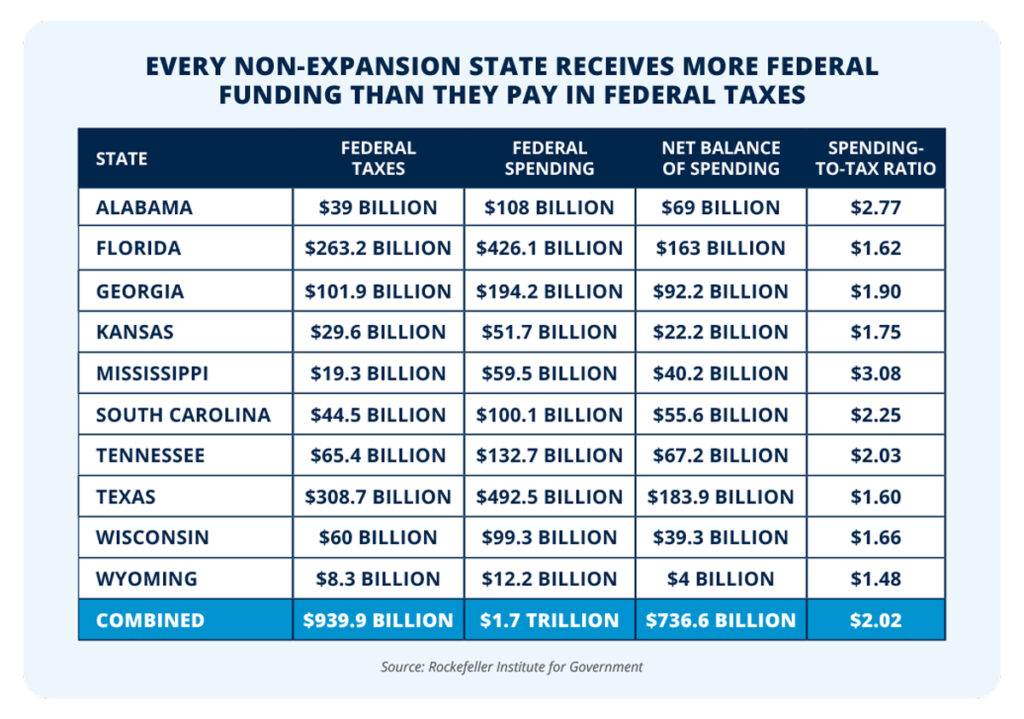

But in reality, the opposite is true—states already receive significantly more federal funding than they send to D.C., which explains why the national debt has ballooned to a massive $34 trillion.8 And in the case of non-expansion states, every single one already receives more federal money than their residents pay in federal taxes.9

For example, Mississippi—a non-expansion state—already receives $3.08 for every federal tax dollar sent to D.C.10 This includes federal income taxes, corporate taxes, etc. In total, Mississippi received $40 billion more than residents paid in federal taxes.11 Likewise, the neighboring state of Alabama gets $2.77 back for every dollar sent in federal taxes—resulting in nearly $70 billion more from the federal government than they sent.12

All told, across all non-expansion states, states get back more than $2 in federal funding for every dollar paid in federal taxes—or more than $736 billion than they paid.13

Put simply, every state receives more federal dollars than they send to D.C.—with non-expansion states already getting back more than double what they pay in.14

Myth #2: Non-expansion states are “sending their money to other states.”

Reality: A magic pot of Medicaid expansion money does not exist.

Another frequent claim by expansion advocates is that if states reject Medicaid expansion, those welfare dollars will just be redirected to states that have expanded. Unsurprisingly, this line of thinking fundamentally misrepresents how Medicaid expansion is funded.

The Medicaid program is a federal-state partnership, meaning that states administer the program and a portion of program costs are reimbursed by federal tax dollars.15 States are only reimbursed for actual expenditures accrued by enrollees—expansion status plays no role in the funding mechanism.16

As explained by the Congressional Research Service: “If a state doesn’t implement the ACA Medicaid expansion, the federal funds that would have been used for that state’s expansion are not being sent to another state.”17 Despite what expansion advocates may claim, there is no magic pot of money.

This means that non-expansion states are not “sending their money” to expansion states by rejecting expansion—that money is never spent. The amount of federal funding expansion states receive will continue to be based on actual expenditures—the same way non-expansion states are reimbursed.18 Expansion states are not gifted extra tax dollars—there is no magic pot of Medicaid expansion money.

Myth #3: States cannot help reduce the national deficit and debt.

Reality: Expanding Medicaid expands the national debt.

ObamaCare proponents have also argued that expanding Medicaid does not impact the national deficit or debt—at times, advocates have even suggested to lawmakers that if they want to impact federal spending, they should run for federal office, the implication being that states cannot help reduce spending at the federal level.19

This is simply untrue, as the decision to expand or reject Medicaid expansion has a direct effect on federal spending and the national debt. Indeed, all Medicaid expansion spending is deficit spending, which causes the national deficit to increase.

In 2023, the federal government collected $4.4 trillion in taxes—but expenditures came in at $6.1 trillion—a deficit of nearly $2 trillion last year alone.20-21 The Congressional Budget Office (CBO) projects trillion-dollar deficits every remaining year of the decade and beyond—even as federal revenues continue to break records.22

Every dollar spent on Medicaid expansion is contributing to the national deficit and debt—there is no dedicated funding stream for expansion. When the Supreme Court ruled on ObamaCare in 2012, and made state participation voluntary, the CBO revised the projected impact of expansion on the national deficit, realizing that many states would reject the proposal.23 Recognizing this reality decreased expansion’s 11-year impact on the federal deficit by nearly $300 billion, as many states would not participate.24 This reduction would be impossible if non-expansion tax dollars were simply being redirected to expansion states, as advocates have repeatedly claimed.

By rejecting expansion, states are saving taxpayers hundreds of billions of dollars annually—all of which would have ultimately been added to the national debt. By standing firm, policymakers in non-expansion states are protecting the truly needy by rejecting welfare expansion.

Myth #4: Medicaid expansion is fully funded with “free” federal tax dollars.

Reality: States are footing the bill for massive portions of expansion costs.

Medicaid expansion is often proposed as being “free” to states, claiming that the federal government pays the tab. While the federal government paid for the bulk of expansion costs early on, that is far from the case today.25 In fact, federal funding has slowed down over the last several years, shifting significant costs onto states.

In 2014, when expansion began in many states, the federal government footed the bill for 100 percent of the program’s benefit costs, and states were responsible for the increase in administrative costs.26 But in 2017, costs began to shift onto states and increased to 10 percent in 2020—with state taxpayers left holding the bag.27

Non-expansion states should view this as a cautionary tale. A decade ago, it might have been easier for expansion advocates to claim that Medicaid expansion would be “free.” But if states expand now, it will have a direct and immediate impact on their state budgets. Meanwhile, Republicans in Congress and former President Obama have endorsed slashing the federal reimbursement rate for Medicaid even further, shifting more costs onto state taxpayers and decimating budgets.28

Going forward, states will be responsible for at least 10 percent of Medicaid expansion costs. Unfortunately, state taxpayers are going to be on the receiving end of a massive bill—which is very different than “free.”

THE BOTTOM LINE: The promise of free Medicaid expansion money was never true—and remains a lie today.

Ultimately, there is no such thing as “free” money. Taxpayers are paying the bill. States already receive more money than they send to Washington, D.C.29 And by rejecting Medicaid expansion, states are not “sending their money” to expansion states, they are showing fiscal restraint and saving tax dollars.30

Expansion states have seen skyrocketing enrollment and massive cost overruns ravage their Medicaid programs, putting the truly needy in harm’s way and adding hundreds of billions to the deficit.31

There is no such thing as a free lunch, and there is no such thing as free Medicaid expansion funding. Medicaid expansion comes at a high price, as a program that was created to provide a safety net for the truly needy has been transformed into an open-ended welfare program for able-bodied adults.

REFERENCES

1 Congressional Research Service, “Overview of the ACA Medicaid expansion,” Library of Congress (2021), https://crsreports.congress.gov/product/pdf/IF/IF10399.

2 Jonathan Bain, “Busted budgets and skyrocketing enrollment: Why states should reject the false promises of Medicaid expansion,” Foundation for Government Accountability (2023), https://thefga.org/research/states-should-reject-false-promises-of-medicaid-expansion.

3 Kaiser Family Foundation, “Status of state Medicaid expansion decisions: Interactive map,” Kaiser Family Foundation (2024), https://www.kff.org/medicaid/issue-brief/status-of-state-medicaid-expansion-decisions-interactive-map.

4 Jonathan Ingram and Nic Horton, “Dispelling four myths about ObamaCare expansion funding,” Foundation for Government Accountability (2020), https://thefga.org/research/obamacare-expansion-funding-four-myths.

5 Ibid.

6 Ibid.

7 Ibid.

8 Fiscal Data, “What is the national debt?,” U.S. Department of the Treasury (2024), https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/.

9 Laura Schults and Lynn Holland, “Giving or getting? New York’s balance of payments with the federal government,” Rockefeller Institute of Government (2023), https://rockinst.org/wp-content/uploads/2023/03/Balance-of-Payments-Federal-2023.pdf.

10 Ibid.

11 Ibid.

12 Ibid.

13 Ibid.

14 Ibid.

15 Jonathan Ingram and Nic Horton, “Dispelling four myths about ObamaCare expansion funding,” Foundation for Government Accountability (2020), https://thefga.org/research/obamacare-expansion-funding-four-myths.

16 Ibid.

17 Ibid.

18 Ibid.

19 Ibid.

20 Fiscal Data, “How much revenue has the U.S. government collected this year?,” U.S. Department of the Treasury (2024), https://fiscaldata.treasury.gov/americas-finance-guide/government-revenue/#:~:text=Federal%20Revenue%20Overview&text=If%20you%20lived%20or%20worked,4.44%20trillion%20collected%20in%20revenue.

21 Fiscal Data, “How much has the U.S. government spent this year?,” U.S. Department of the Treasury (2024), https://fiscaldata.treasury.gov/americas-finance-guide/federal-spending/#:~:text=Key%20Takeaways,)%2C%20resulting%20in%20a%20deficit.

22 Jonathan Ingram and Nic Horton, “Dispelling four myths about ObamaCare expansion funding,” Foundation for Government Accountability (2020), https://thefga.org/research/obamacare-expansion-funding-four-myths.

23 Ibid.

24 Ibid.

25 Ibid.

26 Ibid.

27 Ibid.

28 Ibid.

29 Ibid.

30 Ibid.

31 Jonathan Bain, “Busted budgets and skyrocketing enrollment: Why states should reject the false promises of Medicaid expansion,” Foundation for Government Accountability (2023), https://thefga.org/research/states-should-reject-false-promises-of-medicaid-expansion.