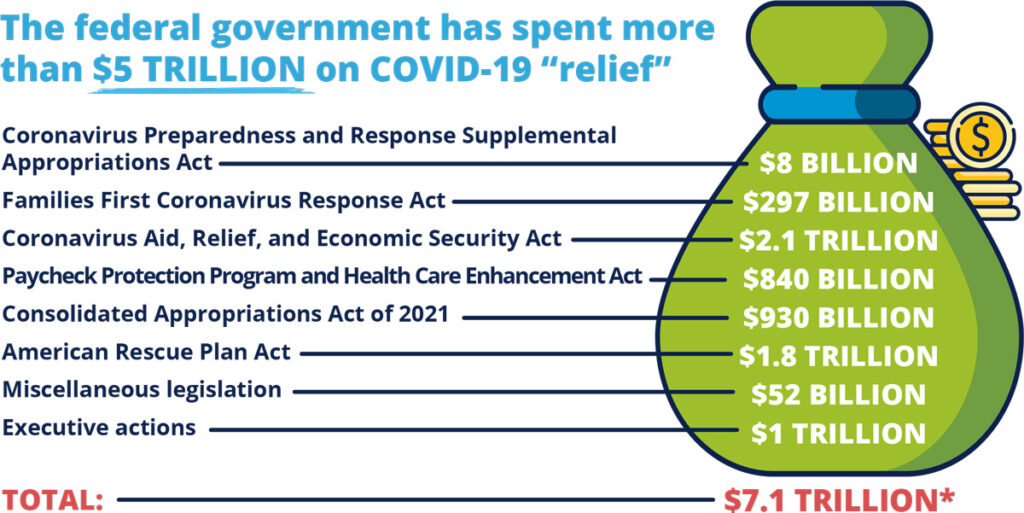

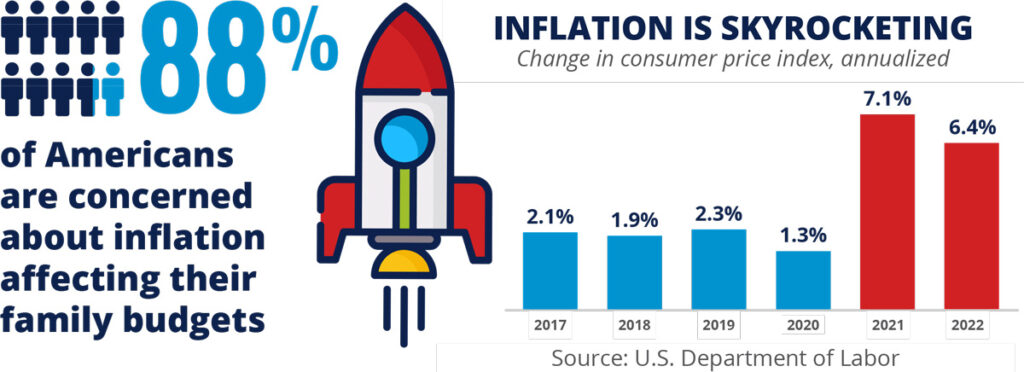

Government Spending Is Driving Out-of-Control Inflation

- BY FGA

Source: *Does not include $7.2 trillion in actions taken by the Federal Reserve

Pandemic-related unemployment programs: $414 billion EXPIRED

These programs included a weekly unemployment bonus of $300 on top of regular benefits, extending how long someone could collect unemployment to more than 18 months, suspending eligibility requirements, and more.

Child Tax Credit changes: $106 billion EXPIRED

These changes converted the tax credit into a monthly allotment, significantly increased the amount of the credit, and made the credit wholly refundable—turning a tax credit for workers into a monthly welfare benefit for non-workers.

Child and Dependent Care Tax Credit changes: $6 billion EXPIRED

These changes made the credit refundable, increased the amount of eligible expenses, increased the credit rate by 15 percentage points, extended the income levels for the program’s phase-out, and made the credit available to individuals living outside the United States.

Earned Income Tax Credit changes: $15 billion MOST CHANGES EXPIRED

These changes expanded eligibility, increased the amount of the credit, and allowed individuals to use previous years’ earnings to qualify.

Food stamp emergency allotments: $35 billion EXPIRED

These changes allowed states to request supplemental monthly allotments and extend eligibility through the duration of the emergency.

Medicaid handcuffs: $200 billion BEGINS PHASING OUT APRIL 1, 2023

These changes provided states with an additional 6.2 percent increase in federal matching funds for traditional Medicaid as long as states agreed not to remove ineligible enrollees until the end of the COVID-19 emergency.

Food stamp work requirement suspension: $2 billion

These changes suspended work requirements for able-bodied adults without dependents.

Continues through the end of the public health emergency declaration (but states can continue to request waivers thereafter)

ObamaCare subsidy changes: $25 billion

These changes expanded eligibility for subsidies on the ObamaCare exchange, increased subsidy amounts, and disregarded all income above 133 percent of the federal poverty level for anyone who collected unemployment benefits at any point of 2021.

Funded through December 2025

Food stamp benefit boosts: $25 billion

These changes unlawfully increased food stamp benefits by 27 percent over pre-pandemic levels. Permanent

Student loan payment suspension: $60 billion

The Biden administration has extended student loan forbearance several times; no payments are required and no interest is being accrued on that debt. This extended loan repayment “pause” is costing taxpayers more than $5 billion a month. Suspended through at least August 2023