Dispelling Common Work Requirement Myths

- BY FGA

MYTH:

Work requirements “punish those in poverty.”

REALITY:

When people move from welfare to work, their incomes double as they find employment and fulfillment across hundreds of industries.

Leftist activists presume that leaving welfare is a bad thing that leaves people worse off. Work requirements do not “punish” those in poverty—they encourage people to get off the sidelines and become self-sufficient. Work requirements are designed to provide a pathway out of dependency and help people build the skills and experience they need to succeed in the workforce.

MYTH:

Parents can’t meet the work requirement.

REALITY:

Work requirements are a proven way to move all able-bodied adults—including parents—from welfare to work.

According to federal data, 99.6 percent of households potentially impacted by a work requirement have income levels that would qualify for their state’s childcare program.1 Plus, requiring parents who do not meet the work requirement to volunteer can lead to full-time employment, helping model good work behavior for children. Additionally, depending on the welfare program, many parents are already exempt contingent on the age of their child or other children in the household.

MYTH:

Enrollees are thrown off the “welfare cliff” without a parachute.

REALITY:

Major welfare programs include off-ramps, transitioning enrollees out of welfare down a long slope, not off a cliff.

Welfare proponents argue that there is a “cliff” that individuals fall off once they reach a certain income level, leading to a decline in total resources. The reality is welfare benefits are gradually reduced so that increases in income accumulate more quickly than the decline in benefits.2 For example, benefits in food stamps are calculated based on income. As income increases, benefit amounts slowly ratchet down, but do not stop immediately—and are more than offset by increases in earnings from work.

MYTH:

Most recipients are near the edge of the “welfare cliff” and working would push them over.

REALITY:

Very few able-bodied adults are near the cliff because most of them do not work at all.

Dependency advocates claim that most enrollees are right near the edge of the cliff, and that being required to work and earn income—even part time—would push them off due to increased income. But 64 percent of able-bodied adults receiving food stamps do not work at all.3 As a result, a large majority of welfare recipients are nowhere near the edge of their eligibility limits.

MYTH:

There aren’t enough jobs for my constituents in rural areas.

REALITY:

Employment, volunteer opportunities, and training programs are within reach of all Americans.

There are nearly 10 million open jobs nationwide.4 Fortunately, not only do most Americans live in areas with workforce programs, but many states are now offering virtual programs to reach even more participants. Additionally, because there are so many different options for participants to choose from to satisfy the work requirement—from job search training to internships—the opportunities are truly endless, even in rural communities!

WHAT ABOUT TRANSPORTATION?

Welfare programs already take transportation into account and offer assistance to help participants access reliable transportation. For example, certain welfare programs offer bus passes or other transportation subsidies to help participants get to work or job training programs.

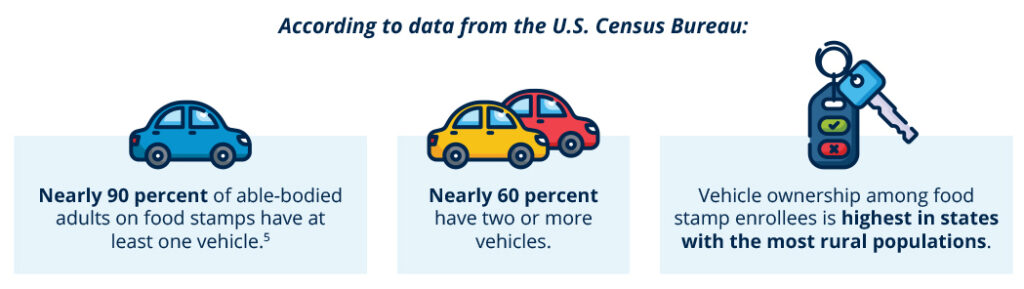

THE FACTS: Overwhelmingly, most able-bodied adults on food stamps own vehicles.

Vehicle Exemptions

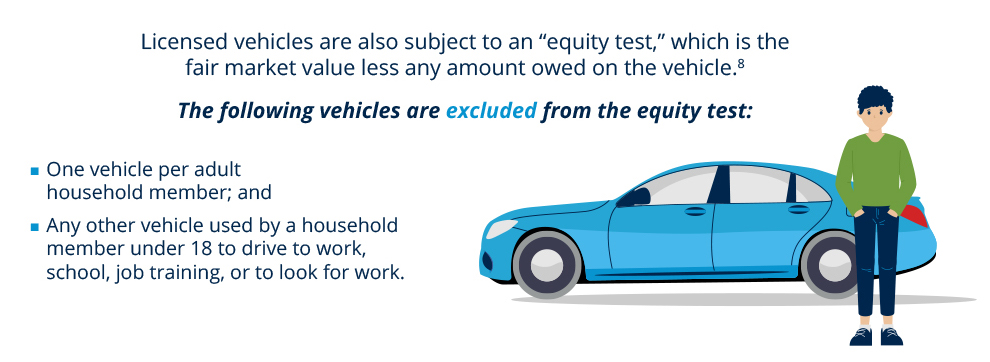

Vehicles count as a resource for food stamp purposes and states determine how vehicles may count toward household resources.6

ALL states exempt at least one vehicle and vast majority (39 states) exclude all vehicles.

Other vehicles are also exempt if they are: 7

- Used for income-producing purposes (e.g., taxi, truck, or delivery vehicle);

- Annually producing income consistent with their fair market value;

- Needed for long distance travel for work (other than daily commute);

- Used as the home;

- Needed to transport a physically disabled household member;

- Needed to carry most of the household’s fuel or water; or

- If the sale of the vehicle would result in less than $1,500.

OPEN JOBS AND TRAINING PROGRAMS ARE PLENTIFUL IN BOTH URBAN AND RURAL AREAS

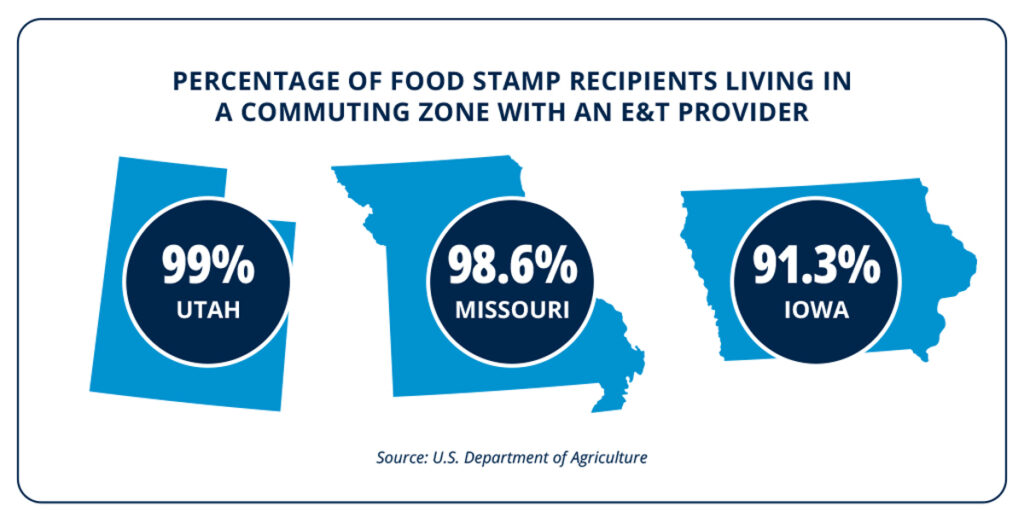

Individuals have countless options to satisfy work requirements, even in rural areas; in fact, most welfare recipients are within driving distance of a job. Outside of virtual options, in most rural states, there are employment and training (E&T) providers in most of the U.S. Department of Agriculture’s designated commuting zones (which are areas designated to identify local economies).

Of the 10 most rural states in the nation, every single one has more than one employment or training option, typically averaging four to six options per state. Most of these rural states offer at least one option across the entire state.

REFERENCES

- Jonathan Ingram, et.al, “The Case for Expanding Food Stamp Work Requirements to Parents,” Foundation for Government Accountability (2018), https://thefga.org/research/case-expanding-food-stamp-work-requirements-parents/.

- Jonathan Ingram and Sam Adolphsen, “Three Myths About the Welfare Cliff,” Foundation for Government Accountability (2018), https://thefga.org/paper/three-myths-welfare-cliff/.

- Administration for Children and Families, “Welfare rules databook: State TANF policies as of July 2019,” U.S. Department of Health and Human Services (2016), https://www.urban.org/sites/default/files/ publication/103517/welfare-rules-databook-state-tanf-policies-as-of-july-20190.pdf.

- Jonathan Bain, “Help Wanted: How Assigning Able-Bodied Adults to Employment and Training Programs Can Help Solve the Labor Shortage,” Foundation for Government Accountability (2022), https://thefga.org/research/employment-and-training-can-solve-the-labor-shortage/.

- Bureau of Labor Statistics, “Job Openings and Labor Turnover-Feb. 2023,” Department of Labor (2023), https://www.bls.gov/news.release/pdf/jolts.pdf.

- Author’s calculation using 2021 U.S. Census Bureau vehicle ownership microdata on non-disabled, working-age adults on food stamps. Out of a total 21,051,871 non-disabled working-age adults on food stamps, 18,725,712 had at least one vehicle in the household while 12,532,408 had at least two.

- For non-excluded licensed vehicles, the fair market value over $4,650 counts as a resource. See: U.S. Department of Agriculture, “Snap Eligibility FAQs (2023)”, https://www.fns.usda.gov/snap/recipient/eligibility.

- U.S. Department of Agriculture, “Snap Eligibility FAQs (2023)”, https://www.fns.usda.gov/snap/recipient/eligibility.