At FGA, we don’t just talk about changing policy—we make it happen.

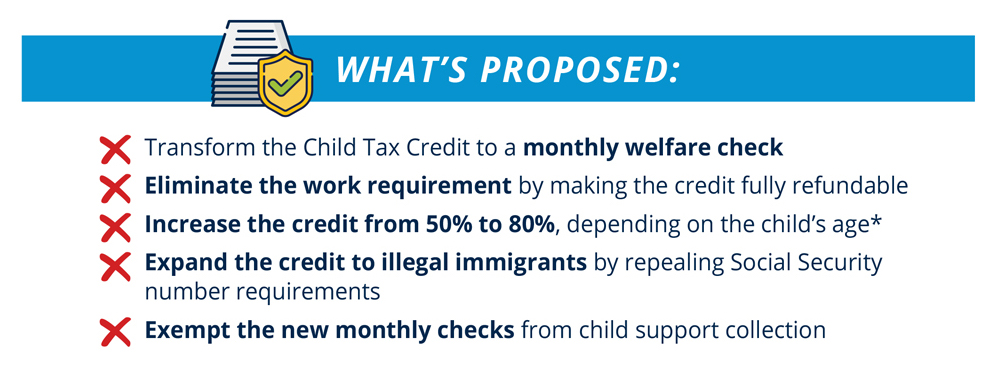

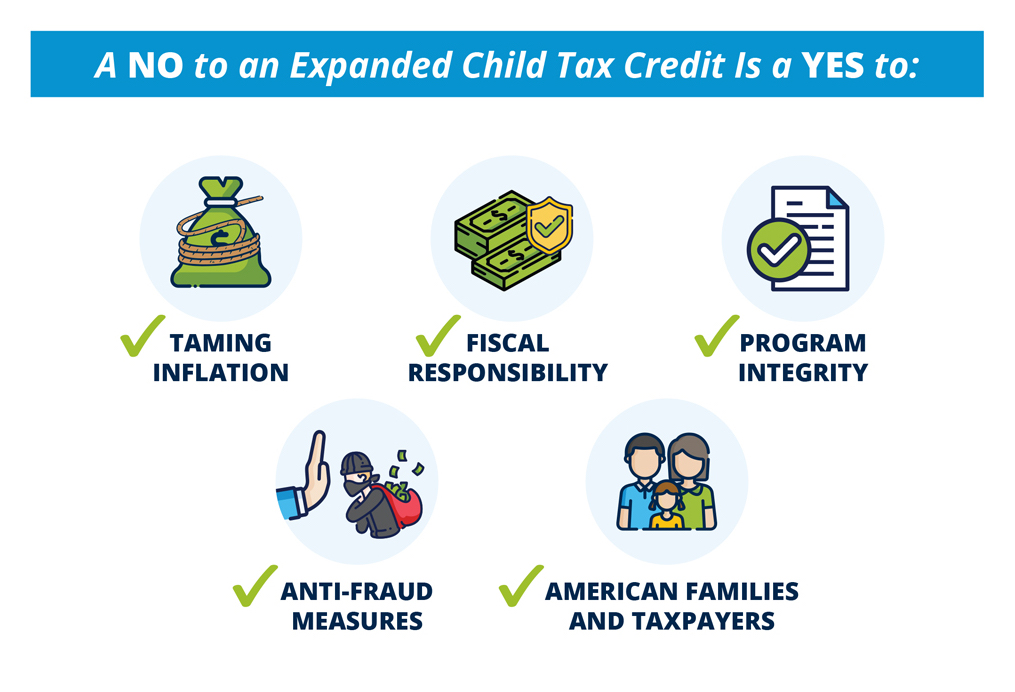

By partnering with FGA through a gift, you can create more policy change that returns America to a country where entrepreneurship thrives, personal responsibility is rewarded, and paychecks replace welfare checks.