Paid Not to Work: How Congress’s unemployment insurance boost hurts low-wage workers

KEY FINDINGS

THE BOTTOM LINE:

FEDERAL AND STATE POLICYMAKERS MUST REVERSE THE DISINCENTIVES CREATED BY THE UI BOOST.

Overview

The American economy has experienced severe turbulence over the last several months, both due to COVID-19 and the consequences of the policy response to address the pandemic. Mandated state shutdowns of businesses across the nation caused economic activity to come to a screeching halt.1 More than 51 million Americans have filed for unemployment insurance (UI) benefits since mid-March—causing UI trust funds across the nation to plummet.2-3

Unfortunately, the response to the crisis by federal policymakers contained in the Families First Coronavirus Response Act (FFCRA) and the Coronavirus Aid, Relief, and Economic Security (CARES) Act made the situation worse. These two pieces of legislation drastically expanded UI benefits through longer benefit duration, the suspension of work search requirements, the inclusion of newly eligible individuals, and a $600-per-week unemployment boost.4-6

The $600 UI boost created a situation where unemployment pays better than work for most Americans. In fact, 68 percent of workers are being paid more on unemployment than they were earning previously, with one in five earning double their prior wages.7 This severe disincentive to work has sent shockwaves throughout the economy, making it more difficult for struggling businesses to hire workers, all while continuing to drain states’ UI funds.8–9 This is especially true for low-wage occupations, which have been severely hurt by this poor policy decision. Meanwhile, some in Congress are pushing to extend this temporary UI boost by another six months, which would have further negative consequences for an economic recovery.10–11

The temporary UI boost is harming the American economy, including low-wage workers

In addition to directly incentivizing unemployment, the $600-per-week UI bump has had adverse ripple effects throughout the economy. Small businesses across the country are desperately struggling to compete with unemployment benefits in order to rehire their workers and reopen their businesses.12 This challenge for small businesses has, unfortunately, resulted in more than 140,000 closing permanently.13 Despite efforts to raise wages, many employers are stuck without a workforce to hire from.14 As a result, even as states reopen, many small businesses find themselves unable to.

Unfortunately, the UI boost has only made economic conditions worse in the long run. Despite a massive increase in unemployment benefits, personal consumption has declined sharply.15 The Congressional Budget Office (CBO) estimates that the decline in real GDP and unemployment will have long-term negative effects on the American economy.16 Even worse, the CBO concludes that extending the UI boost would slow recovery, reduce economic output, and increase unemployment.17

Businesses and sectors with low-wage workers have been among the most severely impacted by COVID-19 and government-mandated shutdowns. The U.S. Department of Labor, for example, determined that workers’ “wages are considerably lower in the highly exposed sector,” and that the economic shutdowns have “disproportionately affect[ed] workers in lower paying jobs.”18–19

However, the UI boost has severely exacerbated the situation for low-wage employment sectors by actively encouraging these workers to remain unemployed.

The UI boost has made it nearly twice as lucrative for low-wage workers to remain on unemployment

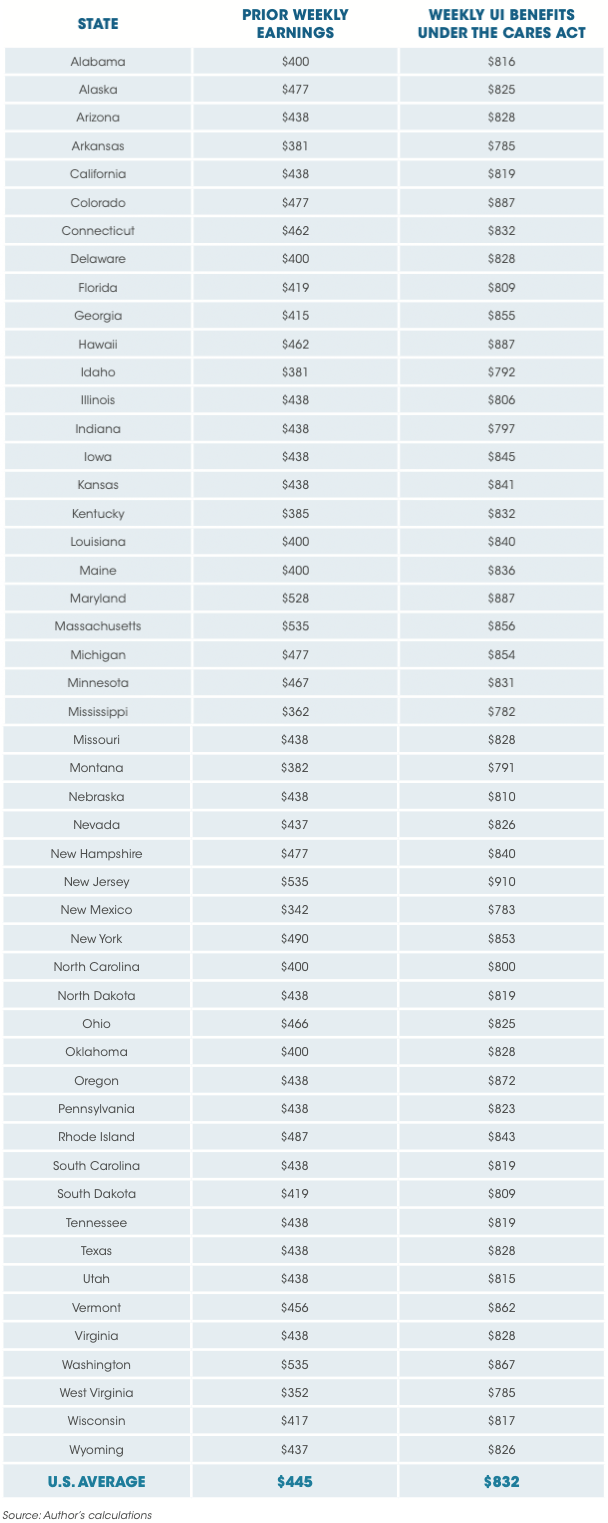

The UI boost has created an economic environment where unemployment is more lucrative than working, especially for low-wage workers. Indeed, as a direct result of the UI boost, unemployed low-wage workers are now receiving nearly twice as much money on unemployment than they earned while working.20 A low-wage worker previously earning $445 per week—roughly $23,000 per year—is now collecting $832 per week in unemployment benefits—the equivalent of more than $43,000 annually.21

In some states, the situation is far more dire. In New Mexico, for example, the average low-wage worker is collecting unemployment benefits worth nearly 2.3 times their previous wages—all without ever showing up for a single day of work.22

While the unemployment boost may be temporary, the job losses it has caused could become permanent as small businesses are forced to close because they can’t compete with the government.

Small businesses would have to pay at least $21 per hour to compete with unemployment

Small businesses trying to reopen and rehire employees must now directly compete with the unemployment system. At least 68 percent of people receiving UI benefits are paid more to remain unemployed than they would earn returning to work.23 The average unemployed low-wage worker is collecting $832 in benefits per week, meaning small businesses would need to offer low-skilled positions at least $21 per hour on a 40-hour work week in order to compete with unemployment benefits.24

But even these higher wages may not be enough to bring unemployed workers back into the labor force, as they would have to work full-time at those much higher wages to earn what they are already collecting in unemployment benefits while not working. Even worse,this does not take into account the value of other welfare benefits they may be receiving, such as food stamps or Medicaid. Small businesses simply cannot compete with the unemployment system paying people more to stay at home than accept a job. This has led to widespread fear among struggling companies, with nearly two-thirds of small business owners fearing that their employees will not return.25

Put simply, across the nation—and as a direct result of bad government policy—unemployment has become far more attractive than work.

UI payments for low-wage workers have nearly quadrupled

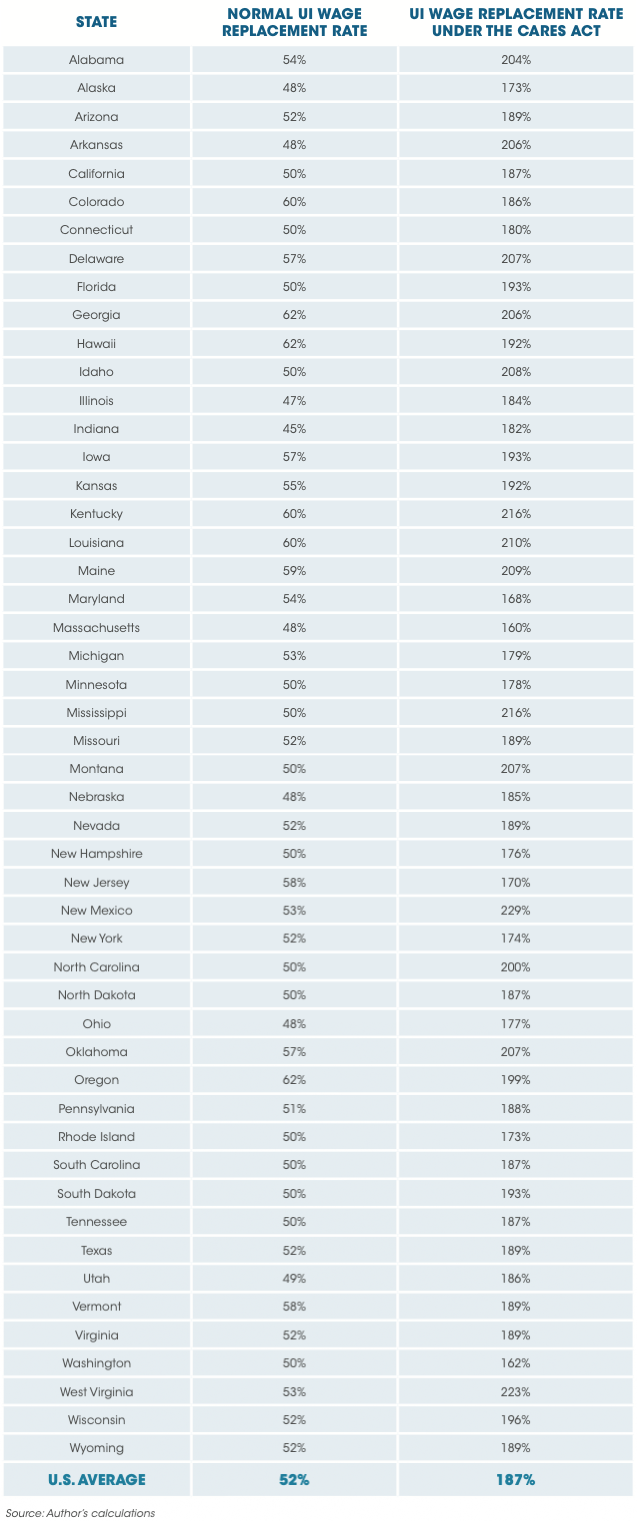

Prior to the COVID-19 outbreak, the average low-wage worker going onto unemployment collected the equivalent of roughly 52 percent of their previous earnings.26 This is what the unemployment insurance system was intended for: to provide a temporary and partial replacement of wages while an individual is looking for a new job.

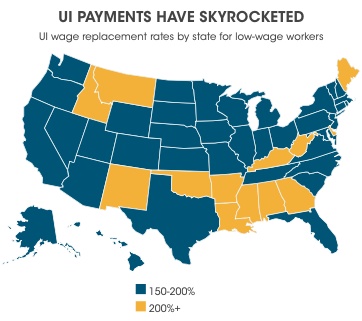

However, the UI boost contained in the CARES Act has fundamentally changed this. Now, the average wage replacement rate for a low-wage worker is an astonishing 187 percent, which is 3.6 times greater than pre-COVID-19 wage replacement rates.27 This has fundamentally altered the function of the unemployment insurance system in a perverse manner.

Bottom line: Federal and state policymakers must act to reverse UI boost disincentives

The economic harm caused by the UI boost is severe and indisputable—but it can be mitigated through the actions of state and federal policymakers.

States can and should make it easier for employers to report individuals who refuse suitable work.30 State policymakers should also make it clear this refusal of work constitutes fraud and will not be tolerated in their state.31 Currently, businesses may not be aware of their options, or are marred down by time-consuming paperwork and bureaucratic reporting processes that would discourage them from taking action.32-33 State policymakers should both clarify the consequences of refusing suitable work and streamline pathways to report instances of fraud.

At the federal level, the Senate and the Trump administration should reject any extension of the UI boost, as has been called for by House Democrats.34 Instead, they should allow this boost to expire at the end of July as scheduled. An extension of the UI boost would mean further detrimental effects on unemployment and output and would place already struggling small businesses in an irreparable situation.35 An expiration, on the other hand, would help fuel a desperately needed American recovery.

As states reopen, businesses should be able to reopen as well—but they need workers. State and federal policymakers must take steps to discourage UI fraud and let the UI boost expire as scheduled in order to fast track the economic recovery.

APPENDIX 1

CARES ACT UI BOOST PAYS LOW-WAGE WORKERS MORE THAN PREVIOUS EARNINGS

Prior weekly earnings and UI benefits under the CARES Act for workers in the 25th income percentile, by state

APPENDIX 2

CARES ACT BOOST NEARLY QUADRUPLED WAGE REPLACEMENT RATES

Normal UI wage replacement rate and UI wage replacement rate under the CARES Act for workers in the 25th income percentile, by state

APPENDIX 3

SMALL BUSINESSES WOULD HAVE TO PAY AT LEAST $21 PER HOUR TO COMPETE WITH UNEMPLOYMENT

Minimum hourly wage needed for a 40-hour work week to match UI benefits under the CARES Act for workers in the 25th income percentile, by state