Manufacturing a Medicaid Crisis: How Ohio Mismanaged its Way into a Disaster

KEY FINDINGS

THE BOTTOM LINE:

OHIO’S MEDICAID PROGRAM IS IN DIRE NEED OF REFORM.

Overview

Across the country, states are experiencing mismanagement of their Medicaid programs as dollars are lost to waste, fraud, and abuse.1 For Ohio, this situation is all too real.

For years, Ohio’s Medicaid program has been plagued with unprecedented budget increases, incorrect enrollment projections, fraudulent claims, improper payments, and more. When Ohio expanded Medicaid to able-bodied adults under ObamaCare, the problem only became less sustainable. And without adequate program integrity procedures in place to guard against fraud, the situation has quickly deteriorated.

Ohio’s Medicaid enrollment and spending have reached unprecedented levels

In 2000, Ohio was spending $7.4 billion on Medicaid.2 Today, that figure has increased to nearly $32 billion—a 332 percent increase.3

Most of this change can be directly attributed to the state’s decision to expand Medicaid under ObamaCare in 2014. Before expansion was implemented in Ohio, state officials promised enrollment would cap out at 447,000 by 2020.4 By 2020, enrollment had reached nearly 750,000.5 And today, enrollment in the state’s expansion population of able-bodied adults stands at more than 850,000— roughly 90 percent above initial state estimates.6

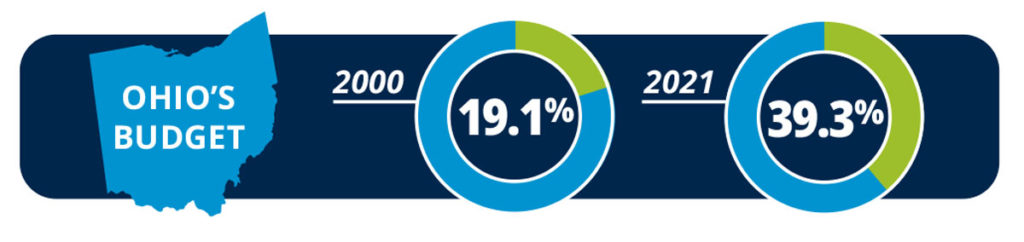

It is unsurprising that in 2000, Medicaid consumed less than 20 percent of Ohio’s budget.7 Today, it accounts for 39.3 percent of Ohio’s expenditures—more than any other state in the nation.8

Unfortunately, much of this spending is thanks to significant improper payments and fraud that the state has done little to get under control.

Adults reveal record-high improper Medicaid payments

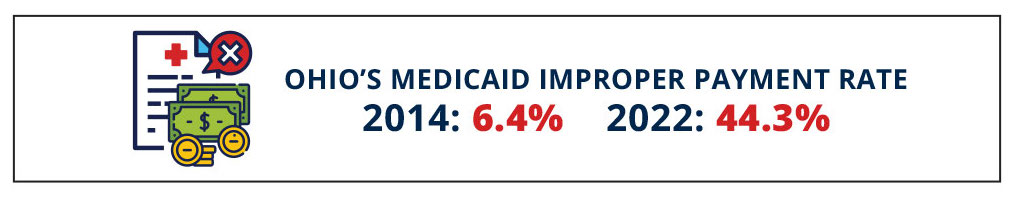

In 2014—at the beginning of Medicaid expansion—Ohio’s Medicaid improper payment rate was just 6.4 percent.9 Today, that figure stands at 44.3 percent—the highest in the nation—meaning that nearly 50 cents of every dollar spent on Medicaid in Ohio is improper.10 These are not simply clerical mistakes or delayed filings. Roughly 98 percent of Ohio’s improper Medicaid payments are directly attributable to eligibility errors.11

This improper payment rate announcement comes on the heels of a recent state audit, which revealed $118.5 million in improper Medicaid capitation payments to managed care organizations between 2017 and 2020.12 Of this $118.5 million, more than $100 million went to incarcerated enrollees, $14.5 million went to duplicate enrollees, and more than $3 million went to deceased enrollees.13 The State Auditor’s Office noted Ohio’s Medicaid program contained missing or inaccurate names, incorrect dates of birth, and more than 80,000 recipients with invalid or missing Social Security numbers.14

While the results of this audit are astonishing, this is not the first instance of Medicaid run amuck in Ohio. An audit by the Office of the Inspector General (OIG) between 2014 and 2016 found that $90.5 million capitation payments were made to deceased Medicaid beneficiaries.15

Another audit by the OIG conducted between 2014 and 2015 found that, of 481,000 expansion enrollees, an estimated 300,000 were ineligible or potentially ineligible, accounting for more than $800 billion in improper Medicaid spending across just six months for the federal share of Medicaid alone.16 A more recent audit conducted in 2019 suggests that, applying the ineligible rates observed to the entire program, there could have been as much as $455 million in program losses due to incorrect eligibility determinations in a single year.17

Time and time again, Ohio’s Medicaid program has proven to be filled with opportunities for bad actors to game the system.

Administrators utilize insufficient program integrity procedures

Ohio’s repeated challenges with its Medicaid program are tied directly to mismanagement.

First, unlike many state Medicaid programs, eligibility determinations for Medicaid in Ohio are made at the county level.18 With 88 counties in the state, this framework makes it difficult to achieve uniformity, consistency, and accountability in processes, as well as in training staff. Instead, counties have greater discretion in these areas—an issue that the state auditor has highlighted as a factor in contributing to poor eligibility determinations.19

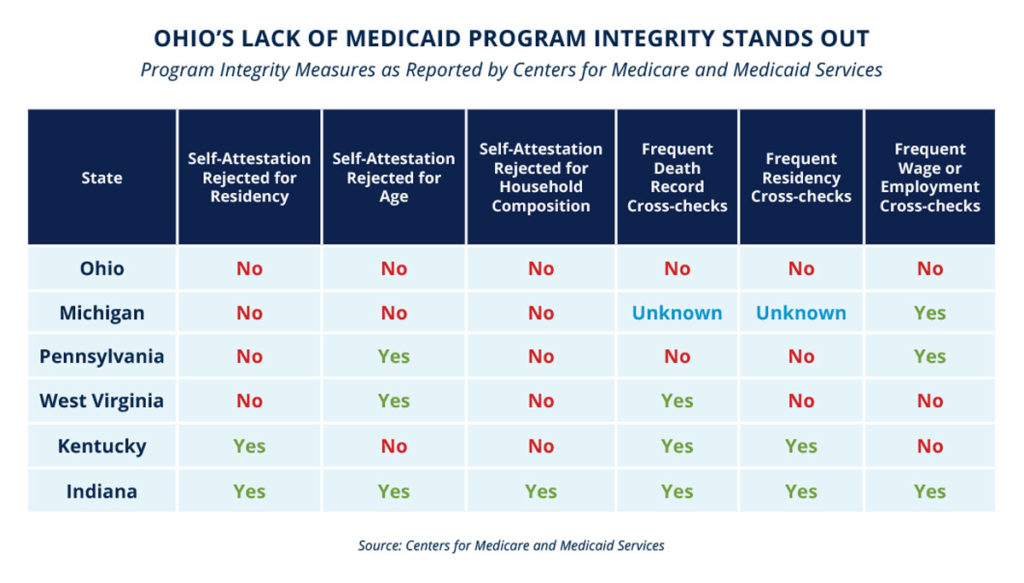

Second, on the front end of the Medicaid enrollment process (as reported by the Centers for Medicare and Medicaid Services), Ohio accepts self-attested information for six critical eligibility factors including residency, age, and household composition.20-21 This is especially notable as Ohio lawmakers passed legislation in 2018 requiring verification of most of these factors.22 However, according to the State Auditor’s Office, this appears to have gone unimplemented.23 Among neighboring states, only Michigan matches Ohio in its willingness to frequently accept self-attested information.24 This makes it all too easy for ineligible enrollees to find their way into Ohio’s Medicaid program.

Once enrolled, Ohio has equally inadequate measures in place to ensure recipients maintain eligibility. In every single one of Ohio’s border states, regular data cross-checks are used for death records, residency records, and wage or employment records—or some combination of the three.25 In contrast, according to its state Medicaid plan, Ohio does not regularly

use a single one of these cross-checks, despite their availability and the fact that state and federal agencies already have the necessary data.26 Ohio law only includes vague references to cross-checks which can be conducted at infrequent intervals.27 It is unclear if these statutorily required cross-checks have been implemented.

These missing verification procedures and cross-checks are precisely why Ohio has a more than 40 percent improper payment rate, and why 98 percent of its improper payments are eligibility driven.28 Its Medicaid program is designed without program integrity in mind. Unfortunately, it is taxpayers and the truly needy who pay the price in the form of wasted resources and mismanaged care.

THE BOTTOM LINE: Ohio’s Medicaid program is in dire need of reform.

Across the country, there is a tendency of some state bureaucrats to simply manage the decay in their Medicaid programs—to turn a blind eye to otherwise unacceptable levels of waste, fraud, and abuse—in the name of efficiency or the greater good. Ohio’s model has proven this is not a long-term solution.

Other states should be wary of Ohio’s approach and should not seek to emulate it. Rather, in order to preserve Medicaid resources for the truly needy and be good stewards of taxpayer dollars, states—including Ohio—must take a proactive role in managing their Medicaid programs.

REJECT THE USE OF SELF-ATTESTED INFORMATION

First, states should not accept self-attested information for critical eligibility factors—such as residency, age, and household composition—for Medicaid. On the front end, administrators need to verify information before individuals enter the program.

UTILIZE DATA CROSS-CHECKS

Once on Medicaid, administrators should be required to conduct regular data cross-checks with regular state, federal, and private datasets on an ongoing basis for residency records, death records, and wage and employment records. The state should also prohibit the health exchange from making Medicaid eligibility determinations and instead verify these referrals.

SCHEDULE ANNUAL AUDITS OR REVIEWS

Finally, states can and should conduct annual audits or reviews to verify these procedures are working and identify opportunities for improvement.

Other states—such as Arkansas—have already deployed these commonsense program integrity procedures in their Medicaid programs.29 Ohio and states that find themselves in a similar situation should act as soon as possible to get their Medicaid programs under control and preserve resources for the truly needy.

Ohio’s Medicaid program is at a crisis point. But if Ohio and other states like it act now, they can manage their Medicaid programs, rather than the other way around.

REFERENCES

1. Hayden Dublois and Jonathan Ingram, “Ineligible Medicaid enrollees are costing taxpayers billions,” Foundation for Government Accountability (2022), https://thefga.org/paper/ineligible-medicaid-enrollees-costing-taxpayers-billions/.

2. National Association of State Budget Officers, “2001 state expenditure report,” NASBO (2001), https://higherlogicdownload.s3.amazonaws.com/NASBO/9d2d2db1-c943-4f1b-b750-0fca152d64c2/UploadedImages/SER%20Archive/nasbo2001exrep.pdf.

3. National Association of State Budget Officers, “2021 state expenditure report,” NASBO (2021), https://higherlogicdownload.s3.amazonaws.com/NASBO/9d2d2db1-c943-4f1b-b750-0fca152d64c2/UploadedImages/SER%20Archive/2021_State_Expenditure_Report_S.pdf.

4. Akash Chougule, “John Kasich gets all the credit for Ohio’s failed ObamaCare Medicaid expansion,” Forbes (2016), https://www.forbes.com/sites/realspin/2016/03/08/john-kasich-ohio-failed-obamacare-expansion/?sh=548dc357409c.

5. Ohio Department of Medicaid, “Actual vs. estimated Medicaid eligibles – SFY 2022,” State of Ohio (2022), https://medicaid.ohio.gov/wps/wcm/connect/gov/653dd56a-c82c-4cd1-b7b6-4c0d8bd6281c/Caseload_SFY22_DEC.pdf?MOD=AJPERES&CONVERT_TO=url&CACHEID=ROOTWORKSPACE.Z18_K9I401S01H7F40QBNJU3SO1F56-653dd56a-c82c-4cd1-b7b6-4c0d8bd6281c-nV9IFPv.

6. Ibid.

7. National Association of State Budget Officers, “2001 state expenditure report,” NASBO (2001), https://higherlogicdownload.s3.amazonaws.com/NASBO/9d2d2db1-c943-4f1b-b750-0fca152d64c2/UploadedImages/SER%20Archive/nasbo2001exrep.pdf.

8. National Association of State Budget Officers, “2021 state expenditure report,” NASBO (2021), https://higherlogicdownload.s3.amazonaws.com/NASBO/9d2d2db1-c943-4f1b-b750-0fca152d64c2/UploadedImages/SER%20Archive/2021_State_Expenditure_Report_S.pdf.

9. Centers for Medicare and Medicaid Services, “Medicaid and CHIP 2014 improper payments report,” U.S. Department of Health and Human Services (2014), https://www.cms.gov/files/document/2014-medicaid-chip-improper-payments-report.pdf.

10. Hayden Dublois and Jonathan Ingram, “Ineligible Medicaid enrollees are costing taxpayers billions,” Foundation for Government Accountability (2022), https://thefga.org/paper/ineligible-medicaid-enrollees-costing-taxpayers-billions/.

11. Ibid.

12. Keith Faber, “Improper capitation payments,” Ohio Auditor of State (2022), https://ohioauditor.gov/auditsearch/Reports/2022/Improper_Medicaid_Capitation_Payments_2022_Franklin_FINAL.pdf.

13. Ibid.

14. Ibid.

15. Office of the Inspector General, “Ohio Medicaid managed care organizations received capitation payments after beneficiaries’ deaths,” U.S. Department of Health and Human Services (2018), https://oig.hhs.gov/oas/reports/region5/51700008.pdf.

16. Office of the Inspector General, “Ohio did not correctly determine Medicaid eligibility for some newly enrolled beneficiaries,” U.S. Department of Health and Human Services (2020), https://oig.hhs.gov/oas/reports/region5/51800027.pdf.

17. Keith Faber, “Ohio’s Medicaid Eligibility Determination Processes,” Ohio Auditor of State (2020), https://ohioauditor.gov/auditsearch/Reports/2020/Medicaid_Eligibility_117_Audit_Franklin_2020.pdf.

18. Ibid.

19. Ibid.

20.Centers for Medicare and Medicaid Services, “MAGI-based eligibility verification plan—Ohio,” U.S. Department of Health and Human Services (2019), https://www.medicaid.gov/sites/default/files/2019-12/ohio-verification-plan-template-final.pdf.

21. Keith Faber, “Ohio’s Medicaid Eligibility Determination Processes,” Ohio Auditor of State (2020), https://ohioauditor.gov/auditsearch/Reports/2020/Medicaid_Eligibility_117_Audit_Franklin_2020.pdf.

22. Ohio Legislature, “HB 119,” State of Ohio (2018), https://www.legislature.ohio.gov/legislation/legislation-documents?id=GA132-HB-119.

23. Keith Faber, “Ohio’s Medicaid Eligibility Determination Processes,” Ohio Auditor of State (2020), https://ohioauditor.gov/auditsearch/Reports/2020/Medicaid_Eligibility_117_Audit_Franklin_2020.pdf.

24. Centers for Medicare and Medicaid Services, “MAGI-based eligibility verification plan—Michigan,” U.S. Department of Health and Human Services (2019), https://www.medicaid.gov/sites/default/files/2019-12/ohio-verification-plan-template-final.pdf.

25. Author’s analysis based on MAGI verification plans. See, e.g., Centers for Medicare and Medicaid Services, “Medicaid/CHIP Eligibility Verification Plans,” U.S. Department of Health and Human Services (2022), https://www.medicaid.gov/medicaid/eligibility/medicaidchip-eligibility-verification-plans/index.html.

26. Centers for Medicare and Medicaid Services, “MAGI-based eligibility verification plan—Ohio,” U.S. Department of Health and Human Services (2019), https://www.medicaid.gov/sites/default/files/2019-12/ohio-verification-plan-template-final.pdf.

27. Ohio Legislature, “HB 119,” State of Ohio (2018), https://www.legislature.ohio.gov/legislation/legislation-documents?id=GA132-HB-119.

28. Hayden Dublois and Jonathan Ingram, “Ineligible Medicaid enrollees are costing taxpayers billions,” Foundation for Government Accountability (2022), https://thefga.org/paper/ineligible-medicaid-enrollees-costing-taxpayers-billions/.

29. Arkansas General Assembly, “Senate Bill 295,” (2021), https://www.arkleg.state.ar.us/Bills/FTPDocument?path=%2FBills%2F2021R%2FPublic%2FSB295.pdf.