How Health Care Incentives Are Saving Money in Kentucky

- BY Jared Rhoads

KEY FINDINGS

- Health care pricing varies greatly, even within one state, but higher prices do not necessarily mean higher quality.

- Shared savings incentives empower employees to spend their health care dollars wisely while preserving their choices of which providers to see.

- Kentucky's price transparency tool for public employees has saved state taxpayers $13.2 million.

- The price transparency tool has resulted in real savings, with over $1.9 million in cash benefits paid to public employees in the program's three years.

Across the country, states spend in excess of $30 billion to insure roughly 2.7 million public employee households.1-2 The coverage offered by state employee health plans is often generous, and uptake is high. Among state and local governments, for instance, roughly 89 percent of workers are offered health benefits, and 79 percent of these workers enroll.3 Premiums also tend to be expensive—indeed, higher than private sector premiums due to the characteristics of state employees (e.g., age, marital status, and educational attainment).4 These factors converge to make health benefits for public employees a costly budget item for states.

Many states have looked for ways to control costs. Various approaches have included increasing the employee contribution, rolling out wellness programs, and offering high-deductible options. Some of these approaches have helped to slow the rise in costs, but all have substantial tradeoffs, and few are actually popular among public employees.5-7

For the state of Kentucky, the challenges are much the same. State officials must manage the health care costs of the roughly 150,000 public employees and their family members (260,000 beneficiaries in total, including retirees) in the state employee health plan, called the Kentucky Employee Health Plan (KEHP).8

Kentucky grapples with rising health care costs

Between 2008 and 2011, Kentucky increased the amount that state employees could contribute to their health insurance by 55 percent.9 However, by 2012, the average total premium for an employee and dependents was still over $1,200 per month. To control costs,Kentucky then increased deductibles in two of their more popular plans—achieving some cost control but also increasing employee out-of-pocket costs, an unpopular move.10

Kentucky state officials searched for new approaches to keep health care costs under control while lessening the burden on state employees, a win-win for both the state and its employees.

Two factors seemed to be contributing to the problem: a lack of employee awareness about the prices of health care goods and services and a lack of employee interest and motivation to make prudent choices.

At the time, employees had neither the ability nor the incentive to shop around for the most affordable services when they needed care. Prices were not readily available for routine diagnostic imaging services such as abdominal CT scans and digital mammograms or for relatively minor procedures such as cataract surgery and corrective nasal/ sinus surgery. Prices were even harder to obtain for major surgeries and procedures, such as arthroscopic knee surgery and total hip replacement.

Even within a small geographic area, the price of a procedure like an MRI can vary greatly. Without knowledge about these price variations, Kentucky health care consumers were at risk of selecting a needlessly expensive provider, hospital, or diagnostic center. According to transparency company data, it is estimated that over 70 percent of consumers use a higher-cost option for things like scans and tests when a lower-cost option is available.11

Similarly, without any incentive to shop around for the best value, Kentucky health care consumers did not have a strong reason to care whether they were using a high-cost option. From the consumer perspective, they had paid their insurance premium, some had paid their deductible, and they faced similar co-pays no matter which provider they saw. The fact that one provider might charge twice that of an equivalent provider across the street was more of a concern for the state—which was responsible for paying the claim—than the patient.

Recognizing these factors, one idea emerged as a mutually- beneficial, commonsense solution: encouraging employees to shop for the best value by offering price transparency tools and shared-savings incentives.

Bringing shopping options to Kentucky public employers

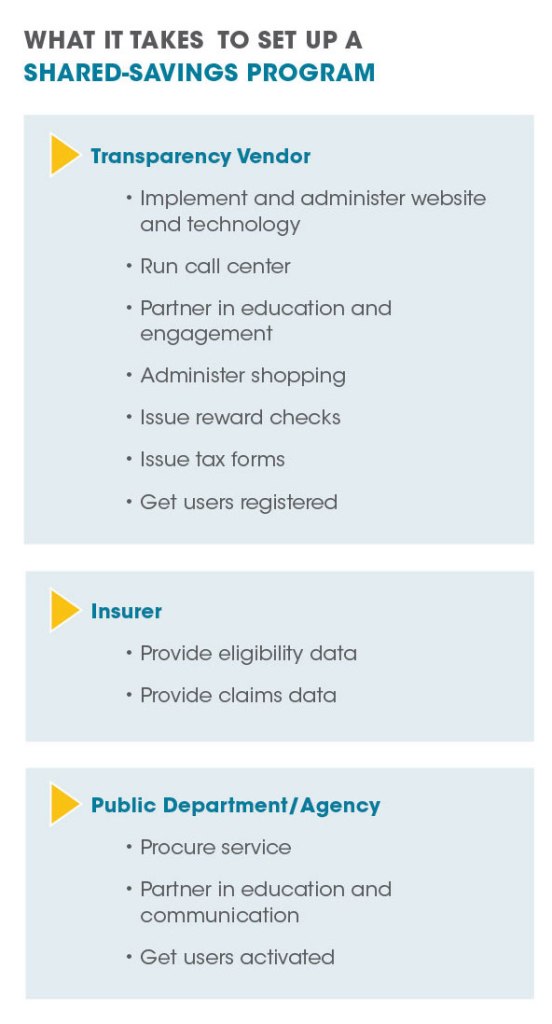

In 2013 and 2014, as Kentucky prepared to launch their new incentive program, state officials formed a cost reduction strategy around the idea of educating members about health care costs. The state ultimately selected Vitals SmartShopper, a technology-enabled third-party service, to empower KEHP members with the ability to shop for health care and keep part of the savings.

The implementation of the Vitals SmartShopper program began as a pilot for state employees in 2013 and was expanded to the full population after proving successful. With no new complicated back-end information technology for the state to adopt, implementation of the program went smoothly.

After the program was implemented on January 1, 2015, the focus for KEHP turned from program setup to program promotion, enrollment, and optimization.

Information about the program was disseminated via announcements and printed materials, as well as by state officials and KEHP staff who visited work sites. Kentucky Department of Employee Insurance Commissioner Jenny Goins, for example, visited road crews and other groups of public employees to encourage them to sign up for the program.12 KEHP also worked with the state wellness vendor and other administrative departments to encourage participation—in 2018, KEHP offered a $15 registration reward in the form of a Visa gift card to the first 1,000 people to sign up. Within 24 hours of the program going live, every gift card had been claimed.

Three years in, participation in the program is growing. Employees across all age groups have enrolled, with individuals in the 56 to 65 year old age category comprising the largest user group, demonstrating that the program is not just an offering for younger, tech-savvy employees.

Five sessions learned from Kentucky’s incentive program

The Vitals SmartShopper program empowers Kentucky public employees to shop for health care services by sharing price information and rewarding them with cash payments when they choose a low-cost provider. All public employees and retirees who are eligible for insurance coverage are eligible to use SmartShopper.

Under the shopper program, incentive rewards differ across services. Incentives generally range from $25 to $500 based on the cost and the savings potential of the service. Employees can go to the lowest cost provider and receive the maximum incentive for a given service, or in many cases they can also go to the second or third most cost-effective provider and still receive a (slightly lower) incentive. For instance, the predetermined incentive for choosing the most cost-effective MRI provider for an abdominal MRI is $150, $75 for the second most cost-effective provider, and $50 for the third most cost-effective provider. Kentucky’s experience has shown that empowering patients with a price transparency tool results in taxpayer savings and direct savings and incentives to members without sacrificing quality.

MORE THAN $13 MILLION IN SAVINGS AND NEARLY $2 MILLION IN INCENTIVES, AND COUNTING

According to data from the state through mid-2018, Vitals Smartshopper has saved state taxpayers a total of $13.2 million in health care costs.13 Over 19,000 incentives have been paid to members for a total of $1,919,460 back into the pockets of public employees.14 The average savings to the state per claim that was “shopped” is $546.15 Kentucky’s program is experiencing a return on investment of 2.7:1 overall, with a target for 2018 of 3:1.16 According to Vitals, as additional services are added such as lab, physical therapy, and infusion, ROI will continue to grow.

KENTUCKY PUBLIC EMPLOYEES ARE SHOPPING

The shopper program has been popular among public employees. Through mid-2018, about 42 percent of eligible households used the program to look up information about prices and rewards, and 57 percent of those employees actively chose a more cost-effective provider. So far, the program has spread more rapidly among female employees, with 81 percent of shoppers being female. These overall levels of interest are consistent with public polling that has shown that more than eight of out 10 voters want the right to know the cost of non-emergency procedures ahead of time, and that about seven out of 10 support the idea of rewarding patients directly when they shop to save money.

There are several reasons member engagement has been so strong. Program implementers devoted adequate attention and energy to three key areas: 1) spreading the word about the program so that awareness was high, 2) getting people to register for the program so that there were not any barriers or delays later on when they needed to shop for care, and 3) reminding people to use the program when they need to shop for care (for instance, by automatically mailing postcards to members when members miss an opportunity to earn an incentive).

KENTUCKY PUBLIC EMPLOYEES ARE SHOPPING FOR DIFFERENT SERVICES AND PROCEDURES

KEHP has found that of all the procedures and services currently eligible for shared savings, routine screenings and diagnostic imaging are the most commonly shopped services.The top five most frequently shopped services are: 1) Mammogram, 2) MRI, 3) Colonoscopy, 4) CT Scan, and 5) Ultrasound. As the list of services expands over time, the shopping program will also potentially help lower out-of- pocket costs for employees with chronic health conditions.

As expected, the services that generate the largest savings per case are not necessarily the same services that account for the greatest overall savings. According to data through May 2018, the top procedure in terms of savings per case was bladder repair surgery, and the top procedure in terms of cumulative savings were MRIs.

Most KEHP employees have an opportunity to pick a more cost-effective choice and receive an incentive. According to Vitals, 85 percent of KEHP members do not already go to low-cost providers. Moreover, the lower-cost options that the program helps to identify do not require a great amount of travel. The average distance that enrollees drive to save money is only eight miles.

KENTUCKIANS ARE NOT OVERUSING SERVICES OR SACRIFICING QUALITY

Skeptics expressed concerns that shopping incentives will lead to lower-quality care. However, the Kentucky experience reveals no evidence to suggest that consumers are sacrificing quality of care in order to save money. In fact, the opposite is true as patients are now making decisions based on location, cost, and quality for the first time.

Patients who shop around do not always choose the lowest cost option—many still choose a costlier procedure and forgo the cash incentive. In these cases, shoppers are freely expressing their preference, which could be based on an opinion they have about quality or other factors such as convenience and location.

Some have also speculated that shared savings will lead to overutilization. The experience at KEHP and at other clients of Vitals SmartShopper show that this fear is unfounded. According to Vitals, KEHP has not experienced any unwar- ranted utilization spikes from people seeking care just to re- ceive a cash reward. The one area in which Vitals has seen a slight increase in utilization is in recommended preventive services such as mammograms and colonoscopies, which most clinicians and observers would agree is a good thing and could eventually lower health care costs over the long run. In fact, outreach and education programs have specifically encouraged this change in patient behavior.

KENTUCKY’S SHOPPER PROGRAM COULD REDUCE THE COST OF CARE IN THE LONG TERM

Not only does the Vitals SmartShopper program yield short-term benefits, it might also lead to long-term benefits for Kentuckians in the form of lower health care prices. In response to the price transparency initiative, some hospitals and imaging centers have become aware that their prices are high and have lowered their prices to rank higher on the lists provided to shoppers. For example, one high-cost regional hospital inquired how much they would need to lower their imaging rates to be listed competitively in the shopper program. Working with the provider and the health plan, the hospital lowered their imaging rates for MRIs and CTs by roughly 30 percent to rank higher in the shopper program.18 Similarly, some providers that are already low- cost have reached out to Vitals to provide more information about additional services that they also offer at their locations at competitive prices, which can help expand the set of services eligible for incentives.

Lessons for other states

At a time when most states have shifted at least some of their health care costs back to public employees, new approaches need to be explored that empower patients to help drive costs down long-term. States should consider offering shared savings incentives for smarter health care shopping in order to control health care costs and empower patients with choices.

REFERENCES

- Governing,“State government employment:Totals by job type: 1960-2016, ”Governing (2017), http://www.governing.com/gov-data/public-workforce-salaries/state-government-employment-by-agency-job-type-current-historical-data.html.

- Pew Charitable Trusts and MacArthur Foundation,“State employee health plan spending,” Pew Charitable Trusts and MacArthur Foundation (2014), http://www.pewtrusts.org/~/media/Assets/2014/08/ StateEmployeeHealthCareReportSeptemberUpdate.pdf.

- Bureau of Labor Statistics,“Employee benefits in the United States,” U.S. Department of Labor (2018), https://www.bls.gov/news.release/pdf/ebs2.pdf.

- Bureau of Labor Statistics,“Why are employer-sponsored health insurance premiums higher in the public sector than in the private sector?,” U.S. Department of Labor (2018), https://www.bls.gov/opub/mlr/2018/article/pdf/employer- sponsored-health-insurance-premiums.pdf.

- Mark Japinga, et al,“State employee health plans can be leaders and drivers of value-based initiatives,” Duke Margolis Center for Health Policy (2017), https://healthpolicy.duke.edu/sites/default/files/atoms/files/duke_seph_12.8.17-final.pdf.

- Pew Charitable Trusts and MacArthur Foundation,“State health care spending,” Pew Charitable Trusts and MacArthur Foundation (2016), https://www.pewtrusts.org/-/media/assets/2016/05/state-health-care-spending.pdf.

- Katherine Barrett and Richard Greene,“States’ answer to rising health-care costs for employees? You pay for it,” Governing (2017), http://www.governing.com/topics/mgmt/gov-rising-health-premiums-state-employees.html.

- Commonwealth of Kentucky,“Kentucky employees’ health plan: Seventeenth annual report,” Commonwealth of Kentucky (2017), https://personnel.ky.gov/KGHIB/Annual%202017%20Report.pdf.

- Ibid.

- Jason Bailey,“Shifting health costs to employees has become way state plugs budget,” Kentucky Center for Economic Policy (2016), https://kypolicy.org/shifting-health-costs-employees-become-way-state-plugs-budget/.

- Information provided by Rob Graybill, Vice President of Product and Sales Strategy, on July 17, 2018.

- Information provided by Jenny Goins, Commissioner, Kentucky Department of Employee Insurance on September 10, 2018.

- Jenny Goins,“Healthcare transparency success story,” Kentucky Department of Employee Insurance (2018).

- Ibid.

- Ibid.

- Ibid.

- Foundation for Government Accountability,“Poll: Voters want the right to shop for health care,”Foundation for Government Accountability (2018), https://thefga.org/poll/poll-voters-want-right-shop-health-care/.

- Information provided by Rob Graybill, Vice President of Product and Sales Strategy, Vitals, on July 17, 2018.