How ESG Works (And Why It’s Bad News)

- BY Sarah Coffey

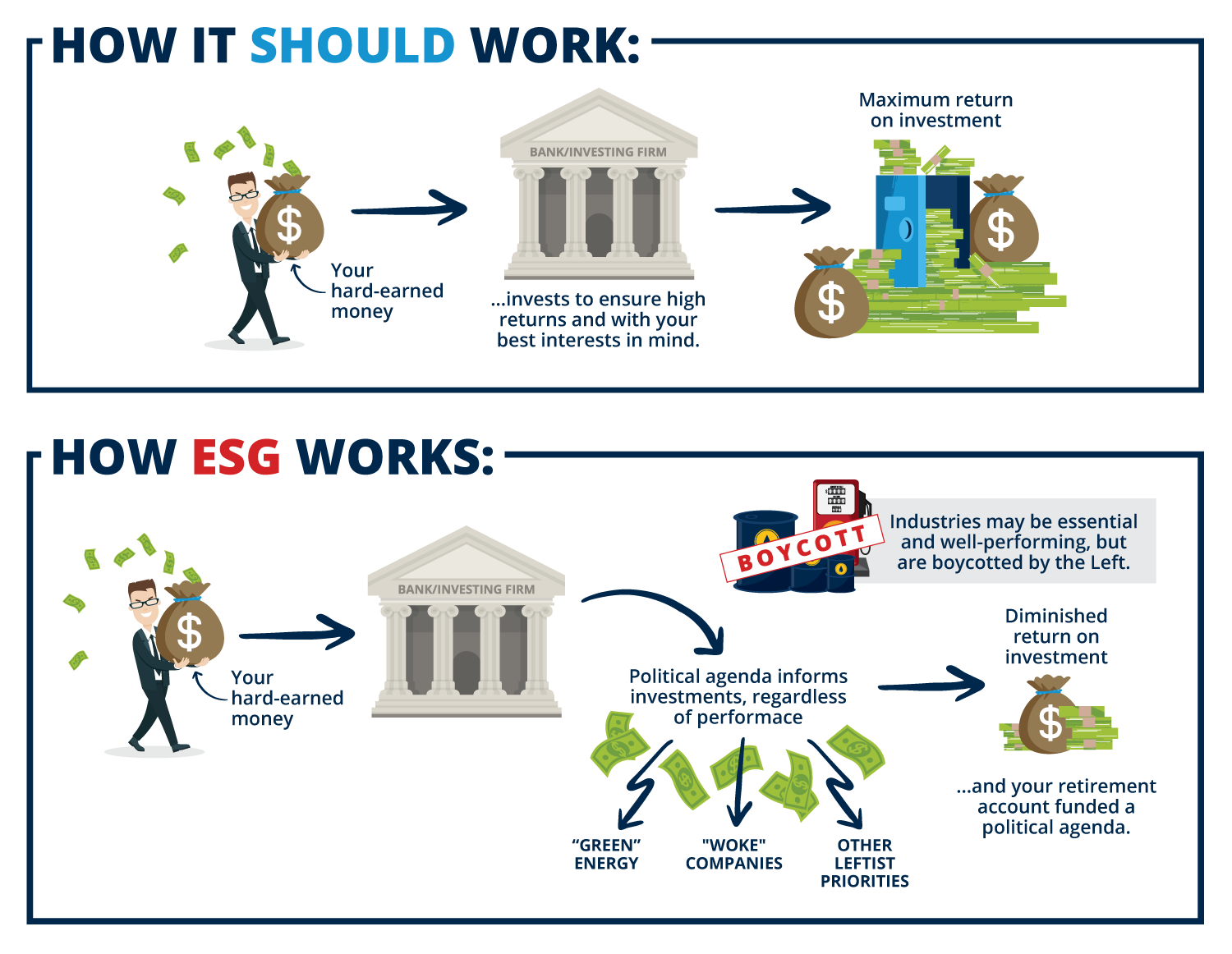

When you invest your hard-earned dollars, you want—and should be able to—trust that the individuals managing your accounts will act in your best interests to achieve as high a return as possible.

But with ESG—or environmental, social, and governance—criteria, investing is driven by a political agenda, not the best interests of investors. And that’s a huge problem.

Here’s how ESG works

It’s an investment strategy that’s catching on fast—roughly one-third of professionally managed assets in the United States now adhere to ESG criteria. ESG is, essentially, politically motivated investing, directing investor dollars not toward success for the individual’s portfolio, but in pursuit of “politically motivated” policy goals like climate change.

First, big corporations and investors set their sights on a given political agenda. Instead of investing to make money or save for retirement—and investing in options that will produce the highest returns—investments that adhere to ESG criteria are made with a political agenda as top priority.

And then they invest with that agenda in mind. Most often, the focus is on climate change. For example, ESG criteria would invest in green energy industries over fossil fuels—even though investments in oil and gas may perform better.

The consequences are that investors accounts suffer, and resources and capital are directed away from the oil and gas industry. The average American’s retirement account, when invested with ESG criteria in mind, is being used to further a political agenda, not bring about the best return and savings for the client. ESG funds are consistently lagging in the S&P 500—they are not selected for their performance, but for their political interest.

And further, the oil and gas industries are deprived of crucial resources and capital, slowing down fossil fuel production and causing fuel prices to skyrocket. Gas and groceries become even more expensive, oil and gas companies must cut jobs, and the threat of an energy crisis looms large.

It’s leftist activism parading as “socially responsible investing”—meanwhile, it’s distorting the free market, and causing major problems for average Americans, their retirement accounts, the oil and gas industries, and the American economy. But ESG is bad news for the economy and the average American for other reasons, too.

- It sets a dangerous precedent. It’s not just oil and gas—in theory, ESG could be applied to any agenda bullet point that the Left considers to be a top priority. The risk of politically motivated investing becoming a way to enact unpopular policies is very real. The Left couldn’t get the “Green New Deal” passed in Congress and aren’t seeing green energy keep up with fossil fuels, so ESG investing is an attempt to artificially prop up the green industry at the expense of fossil fuels.

- It’s an attack on the free market. With ESG, big government and big business are teaming up to choose winners and losers in the economy. Investments aren’t made with financial health or investor prosperity in mind—rather, American investment dollars are used to promote a very specific political agenda, with that agenda taking precedence over the health of the portfolio. Most distressingly, the average American has no choice in the matter, either.

States can combat ESG with commonsense reforms

The great news is that there are ways states can push back against ESG, and many states like Florida, Texas, and West Virginia are already doing so. The top reforms involve bringing accountability to state contracts with ESG institutions, allowing attorneys general to investigate these institutions, and banning ESG investing in state and local pensions and state contracts.

Additionally, policymakers can take strides to ensure financial advisors are truly acting in the best interests of their clients, not their political alignments, by strengthening ethics codes and prioritizing transparency in the industry.

Climate activists and other leftist corporate leaders have united under the banner of ESG to use the marketplace to pursue their political agenda—but it’s not too late to protect American investors and retirement accounts, as well as free enterprise that built our economy.